DOW PIVOTS: CHARTS AND ANALYSIS

________________________________________________________________________________________________________

TUESDAY, FEBRUARY 26, 2013

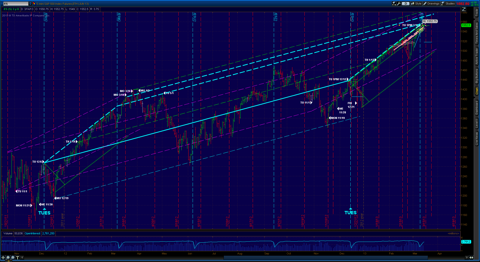

/ES 18 DAILY WITH KEY ACTIVE ANNUAL ECHOVECTOR AND FOCUS INTEREST ECHOBACKDATES: THURSDAY MARCH 14 2013 3:30AM EASTERN DST 0 comments

THURSDAY MARCH 14 2013 3:30AM EASTERN DST

/ES 18 DAILY WITH KEY ACTIVE ANNUAL ECHOVECTOR AND FOCUS INTEREST ECHOBACKDATES

(Click on chart to enlarge and click on chart again to open new tab then click on chart in new tab to zoom)

________________________________________________________________________________________________________

TUESDAY, FEBRUARY 26, 2013

DOW CHART: TOPPY OR NOT?

Next month's options expiration, coming March 15TH, marks the one-year anniversary of the spring 2012's momentum price top for large cap composite equity indexes, as measured by the Dow 30 Industrial Average.

Although this 2012 mid-March price momentum top was re-touched again several times later that March and April, significant lower lows also followed. These lower lows continued until a market bottom for the year was reached in early June, with an almost 10% sell-off in the Dow having occurred.

Prices had fallen from a seasonal high of just over $132, to a June (early) low of $120.19, measured by the DIA ETF. It then took the rest of June, July, and part of August to recover back these gains. On the strength of this price recovery (fueled significantly by Central Bank action and intervention) the DIA climb an additional 2.5% into September, but only to collapse again to near prior summer lows by November, a pattern very similar to prior year price activity.

However, since November 2012, and further keeping with this annual price action pattern, the DIA has gained a remarkable 16% into the present month of February 2013.

With these strong gains since November, some market bears are suggesting the time is now ripe for large cap stocks to begin to correct again, especially after this impressive and extensive level of price recovery and gain. Many bears are considering both seasonality, and relatively lofty current price levels, in their assessments, as well as caution from additional pressures from a relatively faltering European market.

Market bulls, on the other hand, are pointing to things like potential commodity (industrial factor input) price destruction, increased equity demand inflows as an alternative to faltering bonds, and continued aggressive central bank financial engineering, to keep upward market price momentum going. Some bulls also point to the cyclical market benefits that often accompany the second term phase of a Presidency as well.

I believe this coming month of trading, and well into the March 15TH options expiration, could be very revealing regarding the possible continuation of positive market price momentum into this spring, and later into this summer.

I suggest focusing closely on price action and relative strength during the period that spans a week and a half preceding March 15TH, and the two to three week period that immediately follow expiration (particularly the 12 trading days after March 15TH, and beyond).

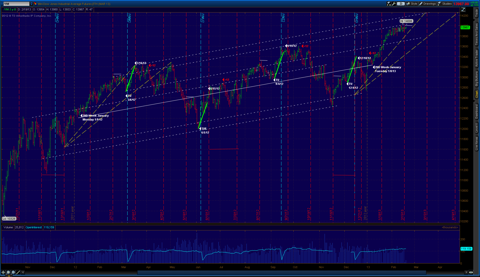

A review of my attached chart of the Dow 30 Industrials E-mini Futures might suggest that a period of potential opportunity on the long side (ceteris paribus) starting the first Tuesday of March, and going into March expiration, might be forthcoming. This long opportunity may then be followed by potential cautionary period, perhaps even a period warranting a good look at the possible employment of large cap portfolio insurance (especially following the 12TH trading day after the March 15TH expiration), if not an outright shorting opportunity period.

I also believe price action over the next 4 weeks may also help foreshadow what price levels the key cyclical price support, and subsequent market up-move later this year may launch from, regarding a broadly anticipated Regime Change Cycle (8 year) price low potentially due this October.

/YM Chart: Dow 30 Industrial Average E-mini Futures:

A 16-Month Daily OHLC Chart with Key Annual EchoVectors

and Quarterly Echo-Back Dates Illustrated

A Chart With Active Annual Price Vectors And Select Quarterly Echo-Strength Vectors Illustrated Generated From Key Coordinated Focus Echo-Back Time Points.

Coordinated Echo-Back Time Points:

1. 2ND Week if February, 2012, to 2ND Week if February, 2013, and

2. Week Preceding Options Expiration (Tuesday), March, June, September and December 2012.

Colors Of Coordinated EchoVectors Illustrated On Chart

Solid White: Annual EchoVector (QEV)

Dotted White: Annual Coordinate Forecast EchoVectors

Solid Green: Echo-Strength Vectors From First Tuesday of Month Coming Before Key Options Expiration Week.

(Click on chart to enlarge and click on chart again to open new tab then click on chart in new tab to zoom)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

This article is tagged with: Market Outlook