"Positioning for change; staying ahead of the curve; we're keeping watch for you!"

THE ECHOVECTORVEST MARKET PRICE PIVOTS FORECAST NEWSLETTER

Currently a regularly updated FREE online newsletter providing valuable and timely market price path analysis and price forecast charts, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOW INCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Irag/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/ Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

See Also Related Web Sites and Blog Sites:

market-pivots.com, stock-pivots.com, dowpivots.com, spypivots.com, goldpivots.com, oilpivots.com, bondpivots.com, dollarpivots.com,currencypivots.com, commoditypivots.com, emergingmarketpivots.com, etfpivots.com, echovectorpivotpoints.com, andseekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest.

DEFINITION: THE ECHOVECTOR

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

SCROLL DOWN TO VIEW THE ECHOVECTOR ANALYSIS CHARTS OF THE DAY

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

SCROLL DOWN TO VIEW THE ECHOVECTOR ANALYSIS CHARTS OF THE DAY

DIRECT LINKS TO THIS MONTH'S SELECT TOPICS, ARTICLES, AND POSTS

- Today Is An Important Day For Goldon FRI, Aug 31 • GLD, IAU, GTU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDIACTED ARTICLE

- Dow Heads To The Downside: It's Not Syriaon WED, Aug 28 • DIA, SPY, QQQ, IWM •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Will Silver's Upside Price Action Continue?

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- As In Previous Quarters, This Is A Very Important Week In The Gold Market

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Is Silver Setting Up For Significant Upside Price Action This Month?

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Today's EchoVector Pivot Point Chart And Analysis: Silver

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

Saturday, August 31, 2013

DOWPIVOTS: DIA ETF: UPDATE AND CHARTS: "Positioning for change, staying ahead of the curve, we're keeping watch for you."

SCROLL DOWN FOR TODAY'S ECHOVECTOR FRAMECHART UPDATE AND

PRE-UPDATE LEAD IN POSTS AND ARTICLE FROM

Saturday, August 31, 2013: DOWPIVOTS: DIA ETF: REITERATION OF THIS PAST WEEK'S ALERT AND ANALYSIS (SEE ECHOVECTOR FRAMECHART) WITH UPDATE

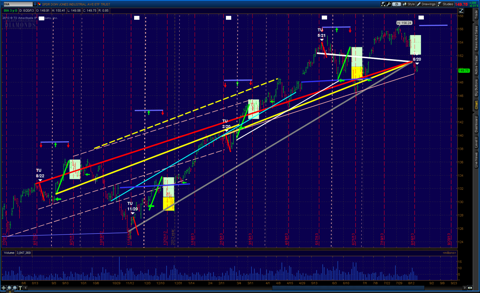

DIA ETF 7-MONTH 2-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Key Bi-Quarterly EchoVectors (Yellow)

Quarterly EchoVectors (White, Aqua-Blue)

Bi-Weekly EchoVectors (Short Aqua-Blue)

Weekly EchoVector (Short White)

Bi-Quarterly Pivoting EchoVectors (Blue-Purple)

Extension Vectors (Short Blue-Purple)

And Key EchoBackDates And Coordinate Forecast EchoVectors With EchoVector Pivot Point Projections

DIA ETF 30-DAY 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Weekly (Short White) and Bi-Weekly (Short Aqua-Blue) EchoVector Highlights and Illustrations

DIA ETF 5-MONTH 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

DIA ETF 4-MONTH 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

DIA ETF 4-MONTH 2-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

ECHOBACKTIMEPOINTS,

KEY EXTENSION VECTORS IN ECHO

AND KEY FORECAST ECHOVECTOR SUPPORT AND RESISTANCE VECTORS WITH ECHOVECTOR PIVOT POINT PROJECTIONS

SUPPLEMENTAL CONTEXT

PRE-UPDATE LEAD IN POSTS AND ARTICLE FROM

Saturday, August 31, 2013: DOWPIVOTS: DIA ETF: REITERATION OF THIS PAST WEEK'S ALERT AND ANALYSIS (SEE ECHOVECTOR FRAMECHART) WITH UPDATE

Wednesday, August 28, 2013: ARTICLE "Dow Heads To The Downside: It's Not Syria"

Wednesday, August 28, 2013: REITERATION OF YESTERDAY'S ALERT AND ANALYSIS (SEE ECHOVECTOR FRAMECHART) WITH UPDATE

Tuesday, August 27, 2013: DOWPIVOTS.COM AND SPYPIVOTS .COM: TODAY'S TOMORROW QUARTERLY ECHOVECTOR CHART PERSPECTIVE: UPDATE AND ANALYSIS

Thursday, August 22, 2013: DOWPIVOTS CHART UPDATE: DIA ETF: TODAY'S TOMORROW ECHOVECTOR ANALYSIS CHART: ANNUAL, TRI-QUARTERLY, BI-QUARTERLY, AND QUARTERLY PERSPECTIVE

(Right click on image of chart to open image in new tab. Left click on the image opened in the new tab to further zoom EchoVector Analysis chart image illustrations and highlights.)

With Key Bi-Quarterly EchoVectors (Yellow)

Quarterly EchoVectors (White, Aqua-Blue)

Bi-Weekly EchoVectors (Short Aqua-Blue)

Weekly EchoVector (Short White)

Bi-Quarterly Pivoting EchoVectors (Blue-Purple)

Extension Vectors (Short Blue-Purple)

And Key EchoBackDates And Coordinate Forecast EchoVectors With EchoVector Pivot Point Projections

DIA ETF 30-DAY 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Weekly (Short White) and Bi-Weekly (Short Aqua-Blue) EchoVector Highlights and Illustrations

DIA ETF 5-MONTH 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

DIA ETF 4-MONTH 1-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

DIA ETF 4-MONTH 2-HOUR OHLC ECHOVECTOR PERSPECTIVE CHART

With Quarterly EchoVector Highlights and Illustrations

__________________________________________________________________________________________________________

TODAY'S ECHOVECTOR FRAMECHART UPDATE

PRE-UPDATE LEAD IN POSTS AND ARTICLES

CONTEXT AND NARRATIVE

Saturday, August 31, 2013

DOWPIVOTS: DIA ETF: REITERATION OF THIS PAST WEEK'S ALERT AND ANALYSIS (SEE ECHOVECTOR FRAMECHART) WITH UPDATE

Wednesday, August 28, 2013

REITERATION OF YESTERDAY'S ALERT AND ANALYSIS (SEE ECHOVECTOR FRAMECHART) WITH UPDATE

The Market is behaving like echovector clockwork... particulary within the Quarterly EchoVector Perspective and FrameWork.

See the chart below issued yesterday for illustration and highlights to this effect.

Note Tuesday's EchoBackDate LAST QUARTER was a short term bottom with a bounce the next several days into the end of the week. The following week brought a 'Tuesday' derivative momentum low on a price and timing basis... timing lows we are again looking for this quarter.

Be cautious about entering into the current market today on the long side if your time frame is not short.

If you are Daytrading into the next several days with a long-side bias and using OTAPS Management Protocols, then you are likely well-approaching and likely to be collecting extra alpha premium rewards to your active management efforts, according to the MDPP EchoVector Model Forecast TradeFrame.

The near-term forward approach and tradeframe and forecast summary issued earlier is still in force:

"Current Outlook Analysis and Swing Trade Implications

After this current further down-pressure week, and it's resumption the following week (after initially bouncing off annual and bi-quarterly echovector support) into the end of August, prepare for one last potential relative strength period from end of first trading Tuesday in September until to mid-September, followed by potential seasonal down-pressure into fall lows. Expect the immediate short-term down-pressure to continue into the end of August and this beginning September period, before staging this final relative strength period and thereafter seeking relative weakness in derivative lows."

Additional Note: also see this morning's globally syndicated article, Dow Heads To The Downside: It's Not Syria, utilizing Echovector Analysis to debunk the journalistic notion of the significance and validity of the current plethora of 'Syria causality inducing' market sell-off articles and headlines.

__________________________________________________________________

See the chart below issued yesterday for illustration and highlights to this effect.

Note Tuesday's EchoBackDate LAST QUARTER was a short term bottom with a bounce the next several days into the end of the week. The following week brought a 'Tuesday' derivative momentum low on a price and timing basis... timing lows we are again looking for this quarter.

Be cautious about entering into the current market today on the long side if your time frame is not short.

After this current further down-pressure week, and it's resumption the following week (after initially bouncing off annual and bi-quarterly echovector support) into the end of August, prepare for one last potential relative strength period from end of first trading Tuesday in September until to mid-September, followed by potential seasonal down-pressure into fall lows. Expect the immediate short-term down-pressure to continue into the end of August and this beginning September period, before staging this final relative strength period and thereafter seeking relative weakness in derivative lows."

__________________________________________________________________

Tuesday, August 27, 2013

DOWPIVOTS.COM AND SPYPIVOTS .COM: TODAY'S TOMORROW QUARTERLY ECHOVECTOR CHART PERSPECTIVE: UPDATE AND ANALYSIS

THE MARKET IS CONTINUING IN ITS FORECAST TRAJECTORY LAST HIGHLIGHTED ON THURSDAY AUGUST 22 2013.

See chart below: Then short term support was projected from Fed Minutes action which had sent the DIA ETF to support on the six month echovector (solid pink) in parallel with the annual echovector (solid red).

This support was forecast to fail however after a 'several days' short-term bounce into this week: see annual echovector echo-back-week for this week.

Note the price momentum failure in this week's 2012 echobackweek proceeding into this period's end of August/early September 2012 second-wave swing trade low.

SEE YELLOW HIGHLIGHTS BELOW. SYRIA RELATED HEADLINES ARE THIS YEAR'S EVENTS.

Left click on chart to enlarge. Right click to open in new tabe. Click again on chart in new tab to further zoom.

DIA ETF QUARTERLY 1-HOUR OHLC CHART PERSPECTIVE

WITH KEY ACTIVE QUARTERLY ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS, ECHOBACKTIMEPOINTS,

KEY EXTENSION VECTORS IN ECHO

AND KEY FORECAST ECHOVECTOR SUPPORT AND RESISTANCE VECTORS WITH ECHOVECTOR PIVOT POINT PROJECTIONS

_____________________________________________________________________

SUPPLEMENTAL CONTEXT

Thursday, August 22, 2013

DOWPIVOTS.COM: DIA ETF: TUESDAY/WEDNESDAY: SUMMARY OF SIGNIFICANT L4 ALERT ACTIONS: READYING FOR FED MINUTES ANALYSIS AND STRATEGY

SHORT-SIDE OPENS AND CLOSES:

BTO TUESDAY AFTERNOON .30

STC WEDNESDAY $.75

BTO WED AFTERNOON .30

STC WED AFTERNOON $.97

LONG SIDE OPENS AND CLOSES

BTO WED MORNING (Mirror CALL, same percent spread as correlate above)

STC WED AFTERNNON (Mirror CALL, same percent spread as correlate above)

BTO WED AFTERNOON (Mirror CALL, same percent spread as correlate above)

STC WED AFTERNOON (Mirror CALL, same percent spread as correlate above)

SUPPLEMENTAL CONTEXT

Tuesday, August 20, 2013

DOWPIVOTS CHART UPDATE: DIA ETF: TODAY'S TOMORROW ECHOVECTOR ANALYSIS CHART: ANNUAL, TRI-QUARTERLY, BI-QUARTERLY, AND QUARTERLY PERSPECTIVE

ECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE EASYGUIDECHARTS

ECHOVECTOR AND COORDINATE FORECAST ECHOVECTOR AND ECHOVECTOR PIVOT POINT COLOR CODE GUIDE

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL ECHOVECTOR ANALYSIS ECHOVECTOR WITH COORDINATE ECHOBACKDATE AND COORDINATE FORECAST ECHOVECTORS AND ECHOVECTOR PIVOT POINT ILLUSTRATIONS AND HIGHLIGHTS COLOR CODE GUIDE FOR TRADER'S EDGE EASYGUIDECHARTS

COLOR CODE GUIDE FOR CHARTS

1. Regime Change Cycle EchoVector (8 Year, Week of month): LongAqua-Blue

2. Regime Change Cycle EchoVector (8 Year, Week of month): LongYellow

3. Regime Change Cycle EchoVector (8 Year, Week of month): LongPink

4. Presidential Cycle EchoVector (4 Year, Day of week): Long White

5. Congressional Cycle EchoVector (2 Year, Day of week): Long Green

6. Congressional Cycle EchoVector (2 Year, Day of week): Long Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day of week): Long Pink

8. Congressional Cycle EchoVector (2 Year, Day of week): Long Yellow

9. Annual Cycle EchoVector (1 Year, Day of week): Red

10. Annual Cycle EchoVector (1 Year, Day of week): Pink

11. Annual Cycle EchoVector (1 Year, Day of week): Aqua-Blue

12. Annual Cycle EchoVector (1 Year, Day of week): Long Blue Purple

13. 9-Month Cycle EchoVector (9 Months, Day of week): Grey

14. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Yellow, Peach

15. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Grey, Aqua-Blue

16. Quarterly Cycle EchoVector (3 Months, Day of week): White

17. Quarterly Cycle EchoVector (3 Months, Day of week): Grey

18. Quarterly Cycle EchoVector (3 Months, Day of week): Red

19. Quarterly Cycle EchoVector (3 Months, Day of week): Green

20. Bi-Monthly Cycle EchoVector (2 Months, Day of week): Black

21. Monthly Cycle EchoVector (1 Month, Day of week): Peach

22. Bi-Weekly Cycle EchoVector (2 Weeks, Day of week): Grey, Peach, Aqua-Blue, Yellow,White

23. Weekly Cycle EchoVector (1 Week, Day of week): Aqua Blue, Red,White, Blue-Purple

2. Regime Change Cycle EchoVector (8 Year, Week of month): LongYellow

3. Regime Change Cycle EchoVector (8 Year, Week of month): LongPink

4. Presidential Cycle EchoVector (4 Year, Day of week): Long White

5. Congressional Cycle EchoVector (2 Year, Day of week): Long Green

6. Congressional Cycle EchoVector (2 Year, Day of week): Long Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day of week): Long Pink

8. Congressional Cycle EchoVector (2 Year, Day of week): Long Yellow

9. Annual Cycle EchoVector (1 Year, Day of week): Red

10. Annual Cycle EchoVector (1 Year, Day of week): Pink

11. Annual Cycle EchoVector (1 Year, Day of week): Aqua-Blue

12. Annual Cycle EchoVector (1 Year, Day of week): Long Blue Purple

13. 9-Month Cycle EchoVector (9 Months, Day of week): Grey

14. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Yellow, Peach

15. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Grey, Aqua-Blue

16. Quarterly Cycle EchoVector (3 Months, Day of week): White

17. Quarterly Cycle EchoVector (3 Months, Day of week): Grey

18. Quarterly Cycle EchoVector (3 Months, Day of week): Red

19. Quarterly Cycle EchoVector (3 Months, Day of week): Green

20. Bi-Monthly Cycle EchoVector (2 Months, Day of week): Black

21. Monthly Cycle EchoVector (1 Month, Day of week): Peach

22. Bi-Weekly Cycle EchoVector (2 Weeks, Day of week): Grey, Peach, Aqua-Blue, Yellow,White

23. Weekly Cycle EchoVector (1 Week, Day of week): Aqua Blue, Red,White, Blue-Purple

24. 3-Day Cycle EchoVector (3 Day, Day-over-Day): Short Grey, ShortWhite

25. 2-Day Cycle EchoVector (2 Day, Day-over-Day): Short Yellow,Short White

26. Daily Cycle EchoVector (1 Day, Day-over-Day): Short Pink, ShortWhite, Short Blue-Purple

27. Select Support and/or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue and/or Blue Purple, Green, Red

Left click on charts to zoom. Click on charts to zoom again further. Right click on charts to open in new tab. Right click on charts in new tab to zoom.

DIA ETF ECHOVECTOR ANALYSIS CHART 1-YEAR DAILY OHLC

WITH KEY ACTIVE ECHOVECTORS FROM THURSDAY 8/15

AND WITH KEY ECHOBACKDATES FOR TUESDAY 8/20

QUARTERLY ECHOVECTOR : WHITE

BI-QUARTERLY ECHOVECTORS: YELLOW AND PEACH AND AQUA-BLUE

TRI-QUARTERLY ECHOVECTOR: GREY

ANNUAL ECHOVECTOR: RED

AND WITH KEY ECHOBACKDATES FOR TUESDAY 8/20

QUARTERLY ECHOVECTOR : WHITE

BI-QUARTERLY ECHOVECTORS: YELLOW AND PEACH AND AQUA-BLUE

TRI-QUARTERLY ECHOVECTOR: GREY

ANNUAL ECHOVECTOR: RED

Current Outlook Analysis and Swing Trade Implications

After this current further down-pressure week, and it's resumption the following week (after initially bouncing off annual and biquarterly echovector support) into the end of August, prepare for one last potential relative strength period from end of first trading Tuesday in September until to mid-September, followed by potential seasonal down-pressure into fall lows. Expect the immediate short-term down-pressure to continue into the end of August and this beginning September period, before staging this final relative strength period and thereafter seeking relative weakness in derivative lows.

Note that this time of year is often accompanied by international events that have been placed on the backburner. These events often serve to act as further volatility drivers in the stock, bond, precious metals, and energy market.

See charts below for additional implications and strategies going into today's Fed Minutes realease and potential price volatility.

DIA ETF 3-DAY 5-MINUTE OHLC

Look for continued weakness tomorrow morning along yellow 2-day downtrend line going into Wednesday's Fed Minutes Release.

DIA ETF PUT OPTION AUG 23 2013 149 WEEKLY

FRIDAY-MONDAY-TUESDAY CHART DEPICTING LOWER LOWS AND $.30 OTAPS ENTRY TARGET

OTAPS L4 Primary Short-side-to-open Rider Vehicle: 1PM EDST TUESDAY Open $.30

Ready for potential algo-driven 'double swing' opportunity, especially in derivative esoterics, and on 'short side to open' opportunity, in and correlate long opportunity in its construction, during potential volatility in Wednesday's Fed Minutes announcement day.

Targeted SSO DIA ETF PEB Derivative Rider Vehicle and its Swing Price Target extrapolated from Tuesday's and Monday's prior trading and echovector analysis setup:

DIA Auguest 23 149 PUT at $.30

SSO Short Side Open

PEB Price Equivalency Basis

Subscribe to: Post Comments (Atom)

No comments:

Post a Comment