- Oct 25, 2013 3:49 PM | aboutstocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM,UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL,DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDSECHOVECTORVEST - PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS - INCLUDING MOTION DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME."Positioning for change; staying ahead of the curve; we're keeping watch for you!"THE ECHOVECTORVEST MARKET PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTERCurrently a regularly updated FREE online newsletter providing valuable and timely market price path analysis and price forecast charts, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOWINCLUDE REGISTERED VIEWS FROM...

Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEAR 2013 ATNasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Financial RoundTable, Financial Board Central, Bullfax, BizWays, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Gold News Today, GoldPivots, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, Sterling Investment Services, Austin Rare Coins and Bullion, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, US Government Portal, Do It Yourself Investor, News Blogged, and others.See Also Related Web Sites and Blog Sites:market-pivots.com, stock-pivots.com, dowpivots.com, spypivots.com,goldpivots.com, oilpivots.com, bondpivots.com,dollarpivots.com,currencypivots.com, commoditypivots.com,emergingmarketpivots.com, etfpivots.com, echovectorpivotpoints.com, andseekingalpha.com/author/kevin-wilbur/instablog/tag/echovectorvest."For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."SCROLL DOWN TO VIEW THE ECHOVECTOR ANALYSIS CHARTS OF THE DAY- DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

- Reviewing Key Active EchoVectors For The Dow 30 Industrials: The /YM Emini Futures

(Regime Change Cycle, Senatorial Cycle, Presidental Cycle, Congressional Cycle, and Annual Cycle EchoVectors, EchoBackDates, Key EchoBackTimePeriods, Coordinate Forecast EchoVectors, Advanced EchoVector Pivot Point Projections, and More Highlighted and Illustrated.)on WED, Oct 23 • DIA, IYM, SPY, IWM, QQQ •PREMIUM ECHOVECTOR ANALYSIS FRAMECHARTSNOW FREELY AVAILABLE GLOBALLY - Don't Fight The Fed (Still Very Much In Force)

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE(First Published August, 2012) - Watch Out Gold

on THU, Sept 5, 2013• GLD, IAU, GTU, NUGT, SLV •PREMIUM ARTICLE NOW FREELY AVAILABLE GLOBALLY

- Today Is An Important Day For Gold

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Dow Heads To The Downside: It's Not Syria

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Will Silver's Upside Price Action Continue?

on THU, Aug 22, 2013 • SLV, GLD, NUGT •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - As In Previous Quarters, This Is A Very Important Week In The Gold Market

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Is Silver Setting Up For Significant Upside Price Action This Month?

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Could This Be A Correction That's Coming? An EchoVector Pivot Point Perspective

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: The Long Treasury Bond

on MON, Aug 5, 2013 • TLT, BOND •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE - Today's EchoVector Pivot Point Chart And Analysis: Silver

on WED, Jul 31, 2013 • SLV, AGOL, GLD •GLOBALLY PUBLISHED AND SYNDICATED ARTICLEGold Charts: Warning In February Still Valid Today

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

- Reviewing Key Active EchoVectors For The Dow 30 Industrials: The /YM Emini Futures

CURRENT POST

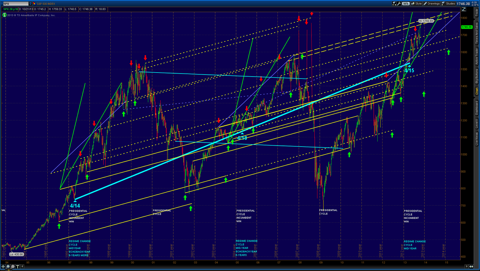

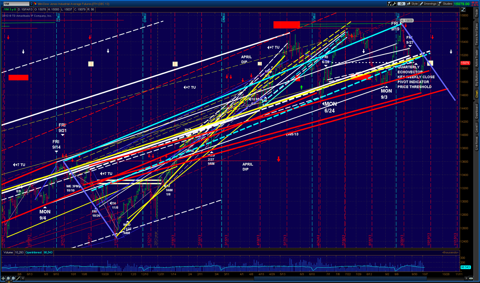

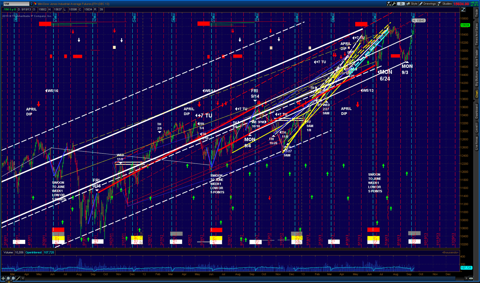

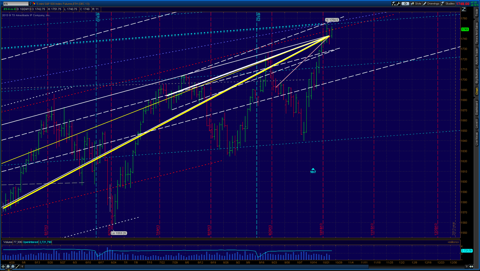

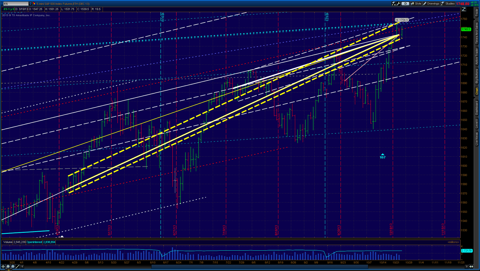

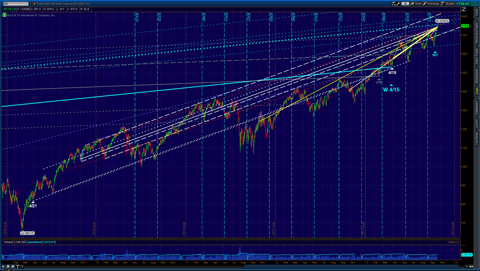

ANALYSIS, ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, AND COMMENTARYFriday, October 25, 2013 MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: MULTI-PERSPECTIVE WITH KEY ECHOVECTORS AND ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS AND COORDINATE FORECAST ECHOVECTORS AND ECHOVECTOR PIVOT POINT PROJECTIONS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE FRI OCT 2513 1150 EDST: 330PM EDST CLOSING PRICE ECHOVECTOR CALCULATION BASISCLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

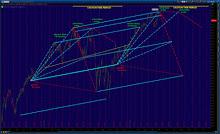

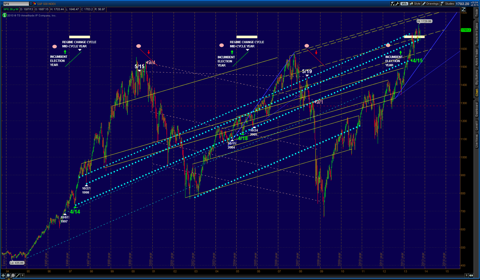

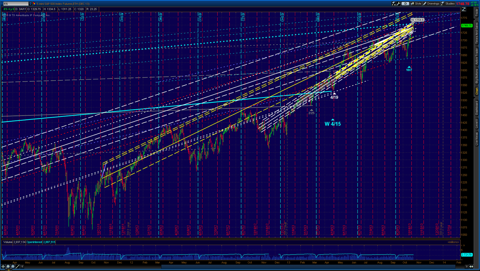

BLUE-PURPLE__________________________________________________________Wednesday, October 23, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: $DJI ECHOVECTOR FRAMECHART UPDATE: 20-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY ACTIVE 8-YEAR REGIME CHANGE ECHOVECTORS AND ECHOBACKDATES: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTERS FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE WEDNESDAY 23 OCT 2013 "Positioning for change, staying ahead of the curve, we're keeping watch for you. ProtectVEST and AdvanceVEST by EchoVectorVEST MDPP Precision Pivots"CLICK ON CHART TO ENLARGE.

OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOM.SEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE, GREEN20-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART

$DJI DOW 30 INDUSTRIALS COMPOSITE INDEX

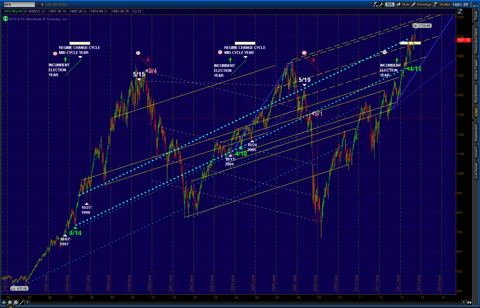

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013Wednesday, October 23, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: SPX ECHOVECTOR FRAMECHART UPDATE: 20-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY ACTIVE 8-YEAR REGIME CHANGE ECHOVECTORS AND ECHOBACKDATES: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTERS FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE WEDNESDAY 23 OCT 2013 "Positioning for change, staying ahead of the curve, we're keeping watch for you. ProtectVEST and AdvanceVEST by EchoVectorVEST MDPP Precision Pivots"SEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE, GREEN20-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART

SPX S&P500 COMPOSITE STOCK INDEX

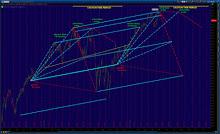

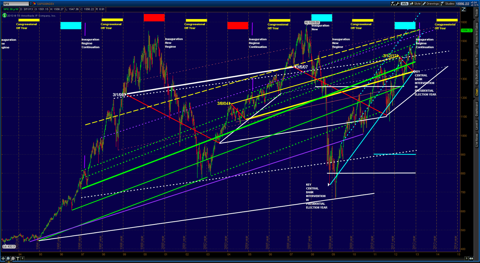

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013Wednesday, October 23, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: $DJI ECHOVECTOR FRAMECHART UPDATE: 20-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY ACTIVE 8-YEAR REGIME CHANGE ECHOVECTORS AND ECHOBACKDATES: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTERS FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE WEDNESDAY 23 OCT 2013 "Positioning for change, staying ahead of the curve, we're keeping watch for you. ProtectVEST and AdvanceVEST by EchoVectorVEST MDPP Precision Pivots"CLICK ON CHART TO ENLARGE.OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOM.SEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE, GREEN20-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART

$DJI DOW 30 INDUSTRIALS COMPOSITE INDEX

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013Posted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 2:10 PMSunday, October 13, 2013SPYPIVOTS.COM AND DOWPIVOTS.COM AND MARKET-PIVOTS.COM: SPX ECHOVECTOR FRAMECHART UPDATE: 20-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY ACTIVE 8-YEAR REGIME CHANGE ECHOVECTORS AND ECHOBACKDATES:PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE SUNDAY 13 OCT 2013 "Staying ahead of the curve, positioning for change, we're keeping watch for you. ProtectVEST and AdvanceVEST by EchoVectorVEST"Monday, September 30, 2013SPX ECHOVECTOR FRAMECHART UPDATE: 20-YEAR WEEKLY OHLC PERSPECTIVE WITH KEY ACTIVE 8-YEAR REGIME CHANGE ECHOVECTORS AND ECHOBACKDATESSUPPLEMENTAL PERSPECTIVEECHOVECTOR ANALYSIS AND ECHOVECTOR PIVOT POINT PROJECTION MARKET NEWSLETTERS BY BRIGHTHOUSE PUBLISHINGPublications with articles, posts, analysis, and commentary regularly utilizing, focusing on, presenting, and/or employing active advanced management forecast, trade, and position management methodologies and technology, including EchoVector Analysis:For current applications of EchoVector Analysis see the following ten (free online) market-oriented newsletters:1. The EchoVector Market Price Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at marketinvestorweekly.com2. The Dow Composite Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at dowpivots.blogspot.com3. The Gold Market Price Pivots Forecaster And Position Management NewsletterBy Gold Investor Weekly and Brighthouse Publishing.

Free Online at goldinvestorweekly.com4. The Silver Market Price Pivots Forecaster And Position Management NewsletterBy Silver Investor Weekly and Brighthouse Publishing.

Free Online at silverinvestorweekly.com5. The Bond Market Price Pivots Forecaster And Position Management NewsletterBy Market Investor Weekly and Brighthouse Publishing.

Free Online at bondpivots.blogspot.com6. The Oil Market Price Pivots Forecaster And Position Management NewsletterBy Market Investor Weekly and Brighthouse Publishing.

Free Online at oilpivots.blogspot.com7. The Commodity Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at commoditypivots.blogspot.com8. The Currency Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at currencypivots.blogspot.com9. The Emerging Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at emergingmarket.blogspot.com10. The ETF Market Price Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at etftraderweekly.com and etfinvestorweekly.comSEEMARKETINVESTORNEWS.COM, MARKETINVESTORWEEKLY.COM, ETFINVESTORWEEKLY.COM, ETFTRADERWEEKLY.COM, GOLDINVESTORWEEKLY.COM, SILVERINVESTORWEEKLY.COM, ECHOVECTOR.INFO, andAFFILIATE DOMAINSDOWPIVOTS.COM, SPYPIVOTS.COM, GOLDPIVOTS.COM, SILVERPIVOTS.COM, OILPIVOTS.COM, BONDPIVOTS.COM, DOLLARPIVOTS.COM, COMMODITYPIVOTS.COM, CURRENCYPIVOTS.COM, EMERGINGMARKETPIVOTS.COM, and ETFPIVOTS.COMPROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS  BY ECHOVECTORVEST MDPP PRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Positioning for change, staying ahead of the curve, we're keeping watch for you!"Special NotationsEchoVector Theory is a price pattern impact theory. EchoVector Analysis is an advanced technical analysis methodology. EchoVector Analysis is also presented as a behavioral economic application and securities analysis tool in price pattern theory and in price pattern behavior, study, and forecasting, and in securities analysis and price analysis and in securities price speculation.EchoVector Pivot Points, special contributions to the field of technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.Kevin John Bradford Wilbur is the postulator of EchoVector Theory, the creator of EchoVector Analysis, and the inventor of EchoVector Pivot Points.Copyright 2013 EchoVectorVEST MDPP Precision PivotsPosted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 3:43 PM

BY ECHOVECTORVEST MDPP PRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Positioning for change, staying ahead of the curve, we're keeping watch for you!"Special NotationsEchoVector Theory is a price pattern impact theory. EchoVector Analysis is an advanced technical analysis methodology. EchoVector Analysis is also presented as a behavioral economic application and securities analysis tool in price pattern theory and in price pattern behavior, study, and forecasting, and in securities analysis and price analysis and in securities price speculation.EchoVector Pivot Points, special contributions to the field of technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.Kevin John Bradford Wilbur is the postulator of EchoVector Theory, the creator of EchoVector Analysis, and the inventor of EchoVector Pivot Points.Copyright 2013 EchoVectorVEST MDPP Precision PivotsPosted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 3:43 PM

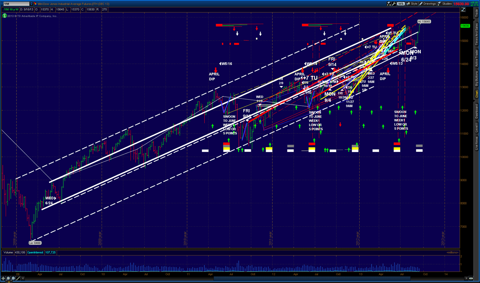

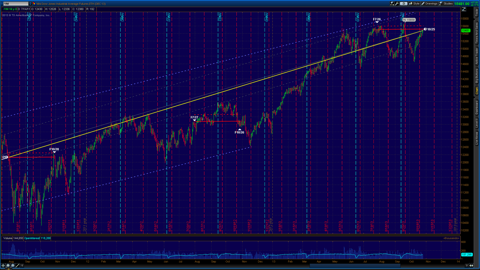

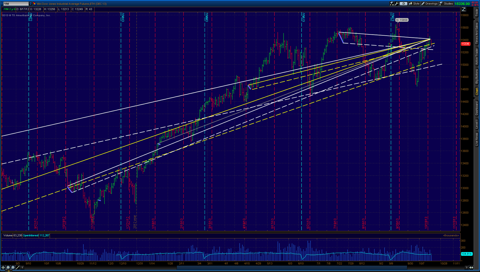

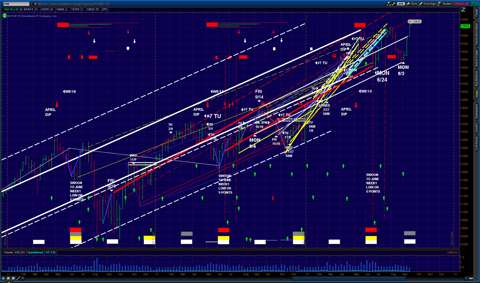

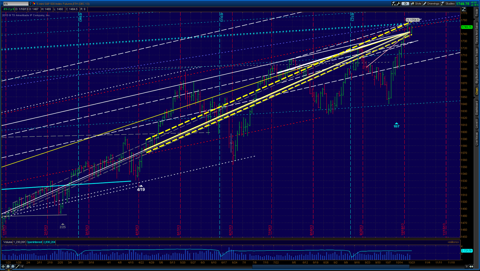

Email ThisBlogThis!Share to TwitterShare to Facebook_________________________________________________________Wednesday, October 23, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: MULTI-PERSPECTIVE WITH KEY ECHOVECTORS AND ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS AND COORDINATE FORECAST ECHOVECTORS AND ECHOVECTOR PIVOT POINT PROJECTIONS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE WED OCT 2013 1150 EDST: PRIOR DAY CLOSING PRICE ECHOVECTOR CALCULATION BASISCLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE1-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA2-YEAR DAILY OHLC ECHOVECTOR FRAMECHART/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURESBASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA5-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA10-YEAR WEEKY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA_________________________________________________________________________________________________________tThursday,October 17, 2013Thursday, October 17, 2013 DOWPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: 5-DAY 10-MINUTE OHLC PERSPECTIVE (WEV) WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE THURSDAY 17 OCT 2013 9:55AM EDST Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.) DOW FUTURES /YM 5-DAY 10-MINUTE OHLC__________________________________________________________________________________________________________Thursday, October 17, 2013Thursday, October 17, 2013 DOWPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: 5-DAY 10-MINUTE OHLC PERSPECTIVE (WEV) WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE THURSDAY 17 OCT 2013 9:50AM EDST (Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.) DOW FUTURES /YM 5-DAY 10-MINUTE OHLC________________________________________________________________________________Thursday, October 17, 2013DOWPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: 5-DAY 10-MINUTE OHLC PERSPECTIVE (WEV) WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE THURSDAY 17 OCT 2013 9:44AM EDST(Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)DOW FUTURES /YM 5-DAY 10-MINUTE OHLC_______________________________________________________________________________________________________________________________Thursday, October 17, 2013DOWPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: 5-DAY 10-MINUTE OHLC PERSPECTIVE (WEV) WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE THURSDAY 17 OCT 2013 (Click to enlarge. Open in new tab and click to enlarge and click again to further zoom.)DOW FUTURES /YM 5-DAY 10-MINUTE OHLCSunday, October 13, 2013DOWPIVOTS.COM: DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART UPDATE: 1-YEAR DAILY OHLC PERSPECTIVE WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS: PREMIUM VIEW RELEASE TO OPEN SOURCE NEWSLETTER FOR GENERAL PUBLIC PURVIEW: PUBLIC RELEASE DATE SUNDAY 13 OCT 2013___________________________________________________Thursday, September 19, 2013PROTECTVEST HEADS UP ALERT: SET UPPER BAND DOUBLE SHORT BIAS OTAPS AT DIA ETF PEB TARGET $157. Set October Lower Band Double Long Bias OTAPS at $147.50 Thursday, September 19, 2013 DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART: 4-YEAR DAILY PRESIDENTIAL CYCLE OHLC PERSPECTIVE WITH KEY ANNUAL AND BI-ANNUAL ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS (click to enlarge) Thursday, September 19, 2013DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART: 2-YEAR WEEKLY AND 2-YEAR DAILY CONGRESSIONAL CYCLE OHLC PERSPECTIVES WITH KEY ANNUAL AND BI-ANNUAL ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODSThursday, September 19, 2013DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART: 1-YEAR DAILY OHLC PERSPECTIVE WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS___________________________________________________________Thursday, October 24, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES: The Regime Change Cycle, The Senatorial Cycle, The Presidential Cycle, The Congressional Cycle, The Annual Cycle EchoVectors, The Tri-Quarterly Cycle, The Bi-Quarterly Cycle, And The Quarterly Cycle EchoVectors, And Their Related Coordinate Forecast EchoVectors, For Base Calculation EchoVector Analysis Starting Reference PriceTimePoint Thursday 24 October 2013 On The /ES S&P50 Emini Futures At Regular Market Hours Close, USA: Premium EchoVectorVEST MDPP Precision Pivots Forecast Model and Analysis Methodology Output Display Perspectives: 'Now Freely Available Globally' Public Release.CLICK ON CHART TO ENLARGE.OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOM.SEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

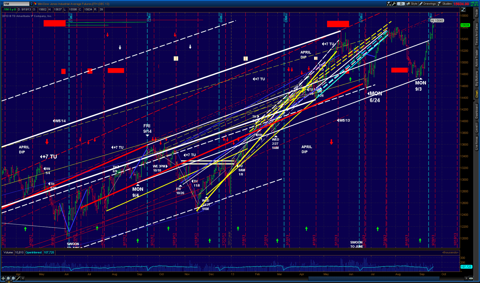

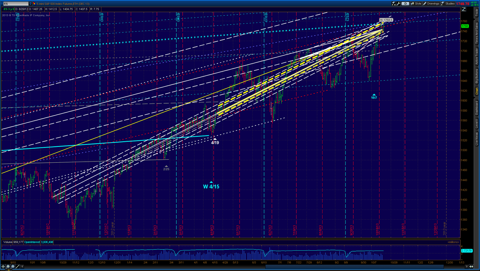

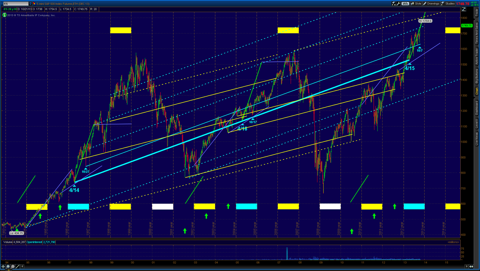

Thursday, September 19, 2013DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART: 2-YEAR WEEKLY AND 2-YEAR DAILY CONGRESSIONAL CYCLE OHLC PERSPECTIVES WITH KEY ANNUAL AND BI-ANNUAL ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODSThursday, September 19, 2013DOW 30 /YM FUTURES ECHOVECTOR FRAMECHART: 1-YEAR DAILY OHLC PERSPECTIVE WITH KEY ECHOBACKTIMEPOINTS AND ECHOBACKTIMEPERIODS___________________________________________________________Thursday, October 24, 2013MARKET-PIVOTS.COM AND DOWPIVOTS.COM AND SPYPIVOTS.COM: S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES: The Regime Change Cycle, The Senatorial Cycle, The Presidential Cycle, The Congressional Cycle, The Annual Cycle EchoVectors, The Tri-Quarterly Cycle, The Bi-Quarterly Cycle, And The Quarterly Cycle EchoVectors, And Their Related Coordinate Forecast EchoVectors, For Base Calculation EchoVector Analysis Starting Reference PriceTimePoint Thursday 24 October 2013 On The /ES S&P50 Emini Futures At Regular Market Hours Close, USA: Premium EchoVectorVEST MDPP Precision Pivots Forecast Model and Analysis Methodology Output Display Perspectives: 'Now Freely Available Globally' Public Release.CLICK ON CHART TO ENLARGE.OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOM.SEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE, GREEN3-MONTH DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA6-MONTH DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA9-MONTH DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA1-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA2-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA4-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA8-YEAR WEEKY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USA18-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART

S&P500STOCK COMPOSITE /ES EMINI FUTURES

BASE CALCULATION TIME: WEDNESDAY 23 OCTOBER 2013 REGULAR MARKET HOURS CLOSE USAECHOVECTOR ANALYSIS AND ECHOVECTOR PIVOT POINT PROJECTION MARKET NEWSLETTERS BY BRIGHTHOUSE PUBLISHINGPublications with articles, posts, analysis, and commentary regularly utilizing, focusing on, presenting, and/or employing active advanced management forecast, trade, and position management methodologies and technology, including EchoVector Analysis:For current applications of EchoVector Analysis see the following ten (free online) market-oriented newsletters:1. The EchoVector Market Price Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at marketinvestorweekly.com2. The Dow Composite Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at dowpivots.blogspot.com3. The Gold Market Price Pivots Forecaster And Position Management NewsletterBy Gold Investor Weekly and Brighthouse Publishing.

Free Online at goldinvestorweekly.com4. The Silver Market Price Pivots Forecaster And Position Management NewsletterBy Silver Investor Weekly and Brighthouse Publishing.

Free Online at silverinvestorweekly.com5. The Bond Market Price Pivots Forecaster And Position Management NewsletterBy Market Investor Weekly and Brighthouse Publishing.

Free Online at bondpivots.blogspot.com6. The Oil Market Price Pivots Forecaster And Position Management NewsletterBy Market Investor Weekly and Brighthouse Publishing.

Free Online at oilpivots.blogspot.com7. The Commodity Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at commoditypivots.blogspot.com8. The Currency Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at currencypivots.blogspot.com9. The Emerging Market Price Pivots Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

Free Online at emergingmarket.blogspot.com10. The ETF Market Price Forecaster and Position Management NewsletterBy Market Investor Weekly and BrightHouse Publishing.

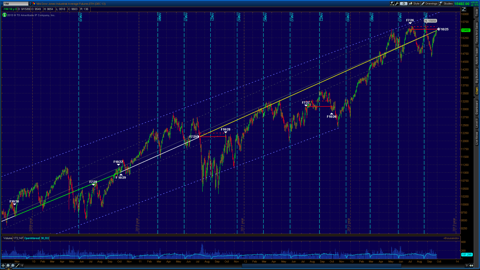

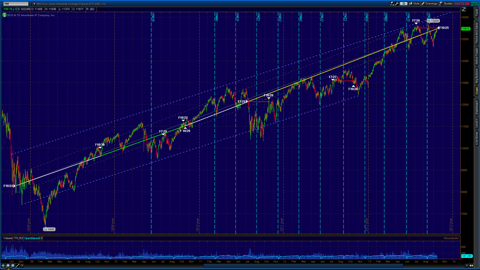

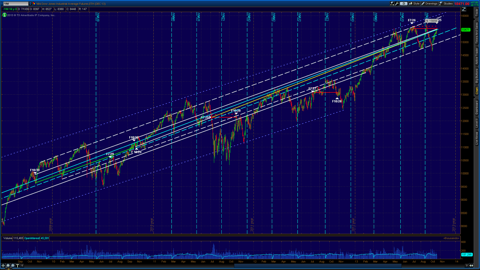

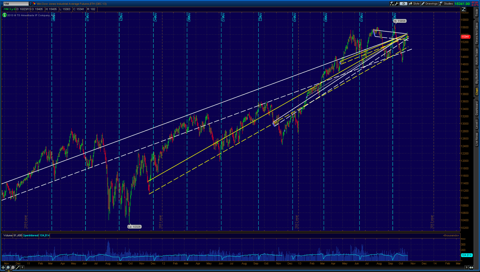

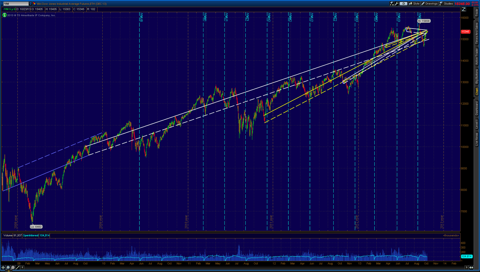

Free Online at etftraderweekly.com and etfinvestorweekly.comSEEMARKETINVESTORNEWS.COM, MARKETINVESTORWEEKLY.COM, ETFINVESTORWEEKLY.COM, ETFTRADERWEEKLY.COM, GOLDINVESTORWEEKLY.COM, SILVERINVESTORWEEKLY.COM, ECHOVECTOR.INFO, andAFFILIATE DOMAINSDOWPIVOTS.COM, SPYPIVOTS.COM, GOLDPIVOTS.COM, SILVERPIVOTS.COM, OILPIVOTS.COM, BONDPIVOTS.COM, DOLLARPIVOTS.COM, COMMODITYPIVOTS.COM, CURRENCYPIVOTS.COM, EMERGINGMARKETPIVOTS.COM, and ETFPIVOTS.COMPROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS  BY ECHOVECTORVEST MDPP PRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Positioning for change, staying ahead of the curve, we're keeping watch for you!"Special NotationsEchoVector Theory is a price pattern impact theory. EchoVector Analysis is an advanced technical analysis methodology. EchoVector Analysis is also presented as a behavioral economic application and securities analysis tool in price pattern theory and in price pattern behavior, study, and forecasting, and in securities analysis and price analysis and in securities price speculation.EchoVector Pivot Points, special contributions to the field of technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.Kevin John Bradford Wilbur is the postulator of EchoVector Theory, the creator of EchoVector Analysis, and the inventor of EchoVector Pivot Points.Copyright 2013 EchoVectorVEST MDPP Precision PivotsReviewing Key Active Echovectors for the Dow 30 Composite: The Regime Change Cycle, The Senatorial Cycle, The Presidential Cycle, The Congressional Cycle, The Annual Cycle EchoVectors, The Tri-Quarterly Cycle, The Bi-Quarterly Cycle, And The Quarterly Cycle EchoVectors, And Their Related Coordinate Forecast EchoVectors, For Base Calculation EchoVector Analysis Starting Reference PriceTimePoint Tuesday 22 October 2013 On The /YM Dow Emini Futures At Regular Market Hours Close, USA: Premium EchoVectorVEST MDPP Precision Pivots Forecast Model and Analysis Methodology Output Display Perspectives: 'Now Freely Available Globally' Public Release.CLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

BY ECHOVECTORVEST MDPP PRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market (Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Tripling Again in 2012!... "Positioning for change, staying ahead of the curve, we're keeping watch for you!"Special NotationsEchoVector Theory is a price pattern impact theory. EchoVector Analysis is an advanced technical analysis methodology. EchoVector Analysis is also presented as a behavioral economic application and securities analysis tool in price pattern theory and in price pattern behavior, study, and forecasting, and in securities analysis and price analysis and in securities price speculation.EchoVector Pivot Points, special contributions to the field of technical analysis, are a technical analysis tool and application within EchoVector Analysis, and derived from EchoVector Theory in practice.Kevin John Bradford Wilbur is the postulator of EchoVector Theory, the creator of EchoVector Analysis, and the inventor of EchoVector Pivot Points.Copyright 2013 EchoVectorVEST MDPP Precision PivotsReviewing Key Active Echovectors for the Dow 30 Composite: The Regime Change Cycle, The Senatorial Cycle, The Presidential Cycle, The Congressional Cycle, The Annual Cycle EchoVectors, The Tri-Quarterly Cycle, The Bi-Quarterly Cycle, And The Quarterly Cycle EchoVectors, And Their Related Coordinate Forecast EchoVectors, For Base Calculation EchoVector Analysis Starting Reference PriceTimePoint Tuesday 22 October 2013 On The /YM Dow Emini Futures At Regular Market Hours Close, USA: Premium EchoVectorVEST MDPP Precision Pivots Forecast Model and Analysis Methodology Output Display Perspectives: 'Now Freely Available Globally' Public Release.CLICK ON CHART TO ENLARGE. OPEN CHART IN NEW TAB AND CLICK ON CHART TO FURTHER ENLARGE AND ZOOMSEE COLOR CODE GUIDEECHOVECTORS2RCCEV 16-YEAR: DOUBLE LONG AQUA-BLUE, DOUBLE LONG YELLOW, DOUBLE LONG BRIGHT PINK

RCCEV 8-YEAR: LONG AQUA-BLUE:SCEV 6-YEAR: LONG GREY: SENATORIAL CYCLEPCEV 4-YEAR: LONG WHITE, LONG GREEN, LONG RED: PRESIDENTIAL CYCLE ECHOVECTORCCEV 2-YEAR: YELLOW: CONGRESSIONAL CYCLE ECHOVECTORAEV 1-YEAR: WHITE, AQUA-BLUE: ANNUAL ECHOVECTOR3QEV 9-MONTH: GREY: TRI-QUARTERLY ECHOVECTOR2QEV 6-MONTH: YELLOW: BI-QUARTERLY ECHOVECTORQEV 3-MONTH WHITE: QUARTERLY ECHOVECTORCOORDINATE FORECAST ECHOVECTORS

SPACEDADDITIONAL COORDINATE ECHOVECTOR LENGTHED PROJECTIONS WITH COORESPONDING ECHOBACKDATE AND/OR ECHOFORWARDDATE PROJECTIONS

DOTTEDCOORDINATE HIGHLIGHTED EXTENSION VECTORS OF COORDINATE OR VARIED LENGTHS AND SLOPE MOMENTUMS

BLUE-PURPLE1-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA2-YEAR DAILY OHLC ECHOVECTOR FRAMECHART/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURESBASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA5-YEAR DAILY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA10-YEAR WEEKLY OHLC ECHOVECTOR FRAMECHART

/YM DOW 30 INDUSTRIALS COMPOSITE EMINI FUTURES

BASE CALCULATION TIME: TUESDAY 22 OCTOBER 2013 REGULAR HOURS CLOSING PRICE USA_________________________________________________________________________________________________________Posted by BY ECHOVECTORVEST MDPP PRECISION PIVOTS at 12:57 AMThemes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots ForecastStocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS - DIRECT LINKS TO RECENT AND SELECT TOPICS, ARTICLES, POSTS, ANALYSIS, AND COMMENTARY

DOWPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR DOWPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.dowpivots.com

CLICK HERE TO GET TO MPF

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

MPF CONSOLIDATED FEED

HOW TO ENLARGE FORECAST FRAMECHARTS

1. Left click on your selected image of the Traders Edge EasyGuide Focus Forecast FrameChart and/or the Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshot.

KEY EVA TIME CYCLE LENGTHS

EUM EUROPEAN MARKET

ASM ASIAN MARKET

O OPEN

C CLOSE

EUMO-EUNC CYCLE

USMO-USMC CYCLE

ASMO-ASMC CYCLE

EUMO-USMO CYCLE

USMO-EUMC CYCLE

ASMC-EUMC CYCLE

ASMC-USMO CYCLE

ASMO-USMO CYCLE

ASMO-EUMO CYCLE

EUMO-USMC CYCLE

1HOUREV

2HOUREV

4HOUREV

6HOUREV

12HOUREV

24HOUREV

48HOUREV

72HOUREV

WEV (WEEKLY CYCLE)

2WEV (2-WEEK CYCLE)

MEV (MONTHLY CYCLE),

2MEV(2-MONTH CYCLE)

QEV (QUARTERLY CYCLE)

2QEV (BI-QUARTERLY CYCLE)

AEV (1-YEAR ANNUAL CYCLE)

CCEV (2-YEAR US CONGRESSIONAL CYCLE)

PCEV (4-YEAR US PRESIDENTIAL CYCLE)

RCCEV (8-YEAR US REGIME CHANGE CYCLE)

MTEV (16-YEAR MATURITY CYCLE)

PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED

WITH KEY ACTIVE EBWs, EBDs, CFEVS, AND OTAPS-PPS TARGET VECTORS ALSO HIGHLIGHTED AND ILLUSTRATED

EXAMPLE ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART PERSPECTIVES AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDMAP GRIDS -- NOW FREE ONLINE FOR 2017!

No comments:

Post a Comment