"Positioning for change; staying ahead of the curve; we're keeping watch for you!"

THE MARKET PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE ETF PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

and

THE E-MINI FUTURES PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

in association with

THE ECHOVECTOR MARKET PRICE PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER

FREE ONLINE VERSIONS

Currently regularly updated and FREE online version market newsletters providing valuable and timely market price path analysis and price forecast charts and potential price pivot timing indicators, advanced market price echovectors and echovector price echo-back-dates, advanced forecast echovector price pivot points, key echovector price inflection points, and advanced coordinate forecast echovector support and resistance vectors for select stocks, bonds, commodities, currencies, and emerging markets composites, with a strong focus on select, proxying and indicative futures and ETF instruments in key markets.

OUR RESEARCHING VIEWERSHIP NOW INCLUDES VIEWS FROM OVER 75 COUNTRIES AROUND THE WORLD! TOTAL VIEWS NOW INCLUDE REGISTERED VIEWS FROM...

Afghanistan/ Argentina/ Australia/ Austria/ Bangladesh/ Belarus/ Belgium/ Belize/ Bermuda/ Brazil/ Burma/ Canada/ Chile/ China/ Columbia/ Costa Rica/ Croatia/ Cyprus/ Czech Republic/ Denmark/ Ecuador/ Egypt/ Estonia/ France/ Finland/ Germany/ Greece/ Guam/ Guernsey/ Hong Kong/ Hungary/ India/ Indonesia/ Iraq/ Ireland/ Israel/ Italy/ Jamaica/ Japan/ Jordan/ Kazakhstan/ Korea/ Latvia/ Lithuania/ Malaysia/ Mexico/ Morocco/ Namibia/ Nepal/ Netherlands/ New Zealand/ Nigeria/ Norway/ Panama/ Pakistan/ Philippines/ Poland/ Portugal/ Romania/ Russia/ Saudi Arabia/ Serbia/ Singapore/ Slovakia/ South Africa/ Sri Lanka/ Spain/ Sweden/ Switzerland/ Taiwan/ Thailand/ Trinidad and Tobago/ Turkey/ Ukraine/ United Arab Emirates/ United Kingdom/ United States/ Uzbekistan/ Venezuela/ Vietnam

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS ARTICLES HAVE APPEARED IN PUBLICATION OR IN SYNDICATION IN YEARS 2013 OR 2014 AT

Nasdaq, CNBC, MSN Money, Yahoo Finance, MarketWatch, Reuters, Barrons, Forbes, SeekingAlpha, BizNewsToday, Benzinga, Business Insider, Daily Finance, StreetInsider, Top10Traders, Fixed Income and Commodities, EchoVectorVEST, Financial Visualizations, YCharts, XYZ Trader Systems, ZeroHedge, Predict WallStreet, Financial RoundTable, Financial Board Central, Bullfax, BizWays, The Finance Spot, Business News Index, Regator, Streamica, BusinessBalla, Finanzachricten, StockLeaf, News Now UK, The Economic Times, Finance Pong, Seeking Alpha Japan, Gold News Today, GoldPivots, AurumX, Sharps Pixley News, Royals Metal Group, A-Mark Precious Metals, Sterling Investment Services, Austin Rare Coins and Bullion, Gold Trend, GoldPrice Today, Gold Rate 24, Check Gold Price, Silver Price News, Silver News Now, Silver Phoenix 500, Silver News, Silver Price, Silver Prices Today, Precious-Metals, VestTrader, Value Forum, Coin Info, Investment Four You, AidTrader, Trend Mixer, Indonesian Company, SiloBreaker, ETF Bannronn, SportBalla, Trading Apples, US Government Portal, Do It Yourself Investor, News Blogged, and others.

PROTECTVEST AND ADVANCEVEST

BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

METHODOLOGY NOTES

"EchoVector Theory and EchoVector Analysis assert that a securities prior price patterns may influence its present and future price patterns. Present and future price patterns may then, in part, be considered as 'echoing' these prior price patterns to some identifiable and measurable degree.

EchoVector Analysis is also used to forecast and project potential price Pivot Points (referred to as PPP's --potential pivot points, or EVPP's --EchoVector Pivot Points) and active, past and future coordinate forecast echovector support and resistance echovectors (SREV's) for a security from a starting reference price at a starting reference time, based on the securities prior price pattern within a given and significant and definable cyclical time frame.

EchoVector Pivot Points and EchoVector Support and Resistance Vectors are fundamental components of EchoVector Analysis. EchoVector SREV's are constructed from key components in the EchoVector Pivot Point Calculation. EchoVector SREV's are defined and calculated and also referred to as Coordinate Forecast EchoVectors (CFEV's) to the initial EchoVector (XEV) calculation and construction, where X designates not only the time length of the EchoVector XEV, but also the time length of XEV's CFEVs. The EchoVector Pivot Points are found as the endpoints of XEV's CFEVs' calculations and the CFEVs' constructions.

The EchoVector Pivot Point Calculation is a fundamentally different and more advanced calculation than the traditional pivot point calculation.

The EchoVector Pivot Point Calculation differs from traditional pivot point calculation by reflecting this given and specified cyclical price pattern length and reference, and its significance and information, within the pivot point calculation. This cyclical price pattern and reference is included in the calculations and constructions of the echovector and its respective coordinate forecast echovectors, as well as in the calculation of the related echovector pivot points.

While a traditional pivot point calculation may use simple price averages of prior price highs, lows and closes indifferent to their sequence in time to calculate its set of support and resistance levels, the echovector pivot point calculation begins with any starting time and price point and respective cyclical time frame reference X, and then identifies the corresponding "Echo-Back-Date-TimeAndPrice-Point (EBD-TPP)" within this cyclical time frame reference coordinate to the starting reference price and time point A. It then calculates the echovector (XEV) generated by the starting reference time/price point and the echo-back-date-timeandprice-point, and includes the pre-determined and pre-defined accompanying constellation of "Coordinate Forecast EchoVector" origins derived from the prior price pattern evidenced around the echo-back-date-timeandprice-point within a certain pre-selected and specified range (time and/or price version) that occurred within the particular referenced cyclical time-frame and period X. Security I's EchoVector Pivot Point constructions then calculate and project the scope relative echovector pivot points that follow A, and the support and resistance levels determined by the ensuing coordinate forecast echovectors and their selected range definition inclusion (fully differentiating the time-sequence of the origins), the cyclical time-frame X, and to XEV's slope.

EchoVector Pivot Points are therefore advanced and fluid calculations and effective endpoints of projected coordinate forecast echovector support and resistance time/price levels, projections that are constructed from and follow in time from the starting reference price, time/price point A (echovector endpoint) of the initial subject focus echovector construction, and which occur within an EchoVector Pivot Point Price Projection Parallelogram construct: levels which are derived from coordinate (support and/or resistance) forecast echovectors calculated from particular 'scope and range defined' starting times and price points reflecting the time and price points of proximate scale and scope and time/price pivoting action that followed the initial subject focus interest echovector's echo-back-date-time-price-point B (derived from and relative to the initial subject focus echovector's starting time-point and price-point A, and the echovector's given and specified cyclically-based focus interest time-span X, and the initial subject focus echovector's subsequently derived slope relative momentum measures).

The EchoVector Support and Resistance Vectors, referred to as the Coordinate Forecast Echovectors, are used to generate the EchoVector Pivot Points."

From "Introduction to EchoVector Analysis And EchoVector Pivot Points" COPYRIGHT 2013 ECHOVECTORVEST MDPP PRECISION PIVOTS

DEFINITION: THE ECHOVECTOR

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

"For any base security I at price/time point A, A having real market transaction and exchange recorded print price p at exchange of record print time t, then EchoVector XEV of security I and of time length (cycle length) X with ending time/price point A would be designated and described as (I, Apt, XEV); EchoVector XEV's end point is (I, Apt) and EchoVector XEV's starting point is (I, Ap-N, t-X), where N is the found exchange recorded print price difference between A and the Echo-Back-Date-Time-And-Price-Point of A, being (A, p-N, t-X) of Echo-Back-Time-Length X (being Echo- Period Cycle Length X).

A, p-n, t-X shall be called B (or B of I), being the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or EBD (Echo-Back-Date)*, or EBTP (Echo-Back-Time-Point) of A of I.

N = the difference of p at A and p at B (B being the 'echo-back-date-time-and-price-point of A found at (A, p-N, t-X.)

And security I (I, Apt, XEV) shall have an echo-back-time-point (EBTP) of At-X (or I-A-EBTP of At-X; or echo-back-date (EBD) I-A-EBD of At-X): t often displayed on a chart measured and referenced in discrete d measurement length units (often OHLC or candlestick widthed and lengthed units[often bars or blocks]), such as 1-minute, 5-minute, 15-minute, 30-minute, hourly, 2-hour, 4-hour, 6-hour, 8-hour, daily, weekly, etc."

DEFINITION: ECHOVECTOR PIVOT POINTS: CLICK HERE

on FRI, Mar 2, 2014,

• SPX, SPY, IYM, DJX, DJI, DIA, OOO, IWM •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW AVAILABLE GLOBALLY

on SUN, Mar 2, 2014,

• SLV, GLD, IAU, GTU, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Feb 26, 2014, With THU Update

• GLD IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Feb 25, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on TUES, Feb 25, 2014, w/ FRI UPDATE • GLD, GTU, NUGT •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on , Jan 12, 2014 • GLD, IAU, GTU, NUGT, SLV •

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on WED, Aug 1 • DIA, IYM, SPY, IWM, QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

(First Published August, 2012)

on THU, Sept 1, 2013 * GLD, IAU, GTU, NUGT, SLV *

PREMIUM MARKET ALPHA NEWSLETTER GROUP ARTICLE NOW FREELY AVAILABLE GLOBALLY

on FRI, Aug 31, 2013 • GLD, IAU, GTU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 28, 2013 • DIA, SPY, QQQ, IWM •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on THU, Aug 22, 2013 • SLV, GLD, NUGT •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 14, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on FRI, Aug 9, 2013 • GLD, NUGT, IAU, GTU, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Aug 7, 2013 • DIA, IYM,SPY, DIA, IWM,QQQ •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, Aug 5, 2013 • TLT, BOND •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on WED, Jul 31, 2013 • SLV, AGOL, GLD •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

on MON, May 31, 2013 • GLD, GTU, IAU, NUGT, SLV •

GLOBALLY PUBLISHED AND SYNDICATED ARTICLE

GOLDPIVOTS.COM PREMIUM RELEASE: 7-POINT MORNING BRIEF: Gold Metals Market Analysis With EchoVector Pivot Point FrameCharts Included: MDPP Premium Desk Release: Friday 28 February 2014: GLD ETF

This Week's EchoVector Pivot Point Analysis And Chart: Gold

Fri, Feb. 28"A Time For Gold Caution, Or A Time To Buy More?" PREMIUM ARTICLE RELEASE TO MARKET ALPHA BRAND NEWSLETTERS GROUP. ARTICLE NOW AVAILABLE ONLINE FREE GLOBALLY. GOLDINVESTORWEEKLY.COM AND GOLDPIVOTS.COM AND COMMODITYPIVOTS.COM AND MARKET-PIVOTS.COM

CAUTION ALERT: GOLD METALS MARKET: GLD ETF PRESIDENTAL CYCLE ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART UPDATE AND OTAPS-PPS ACTIVE ADVANCED POSITION MANAGEMENT ALERT: TUESDAY 2/25/14: PREMIUM MARKET ALPHA BRAND NEWSLETTER GROUP RELEASE

/ES EMINI FUTURES S&P500 STOCK COMPOSITE INDEX ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHARTS & OTAPS-PPS POSITION POLARITY SIGNAL VECTOR FORECAST GUIDEMAPS UPDATE: TUES 2/25/14 115PMEST: PREMIUM DESK PARTIAL RELEASE TO MARKET ALPHA NEWSLETTERS GROUP ET AL

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL VECTOR GUIDEMAP UPDATES: TUESDAY 2/25/14 1107AM EST: US MARKET: WEEKLY & BI-WEEKLY ECHOVECTOR ANALYSIS PERSPECTIVES

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL VECTOR GUIDEMAP UPDATES: MONDAY 2/24/14 1014PM EST: ASIAN MARKET HOURS: QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE

/ES EMINI FUTURES S&P500 ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS SIGNAL FORECAST PRICE TRIGGER GUIDEMAP FOR MONDAY 2/24/14: 1120AMEST UPDATE: US REGULAR MARKET HOUR 1024AMEST UPDATE: WEEKLY AND DAILY ECHOVECTOR ZOOM PERSPECTIVE

/ES ECHOVECTOR ANALYSIS FRAMECHARTS: MONDAY 2/24/14 UPDATE

BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND FRAMECHART AND OTAPS-PPS PRICE GUIDEMAP UPDATE: TLT ETF PROXY: MONDAY 2/24/14: RIGHT ON T

/ES E-MINI FUTURES SP500 ECHOVECTOR FRAMECHART UPDATES AND ANALYSIS FOR AM THURSDAY 2/20/14: SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: PREMIUM DESK PARTIAL RELEASE

NUGT ETF GOLD MINERS 3X ULTRA ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS: US EXTENDED HOURS MARKET: 2/18/14

GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: TUESDAY 2/18/14: GLD ETF PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES

DJIA LARGE CAP COMPOSITE INDEX: TUESDAY 18 FEBRUARY 2014 UPDATE: POWERFUL RESULTS RIGHT ON TARGET: ECHOVECTOR PIVOT POINT FRAMECHART AND ANALYSIS UPDATES: /YM EMINI FUTURES

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES: POWERFUL FORECAST RESULTS RIGHT ON TARGET: The Presidential Cycle And Related Coordinate Forecast EchoVectors And OTAPS Position Polarity Switch Vectors UPDATE: WEDNESDAY 19 FEBRUARY 2014

NUGT ETF 3X ULTRA GOLD MINERS MARKET PROXY ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: WEDNESDAY 2/12/14 EUROPEAN MARKET OPEN

DOWPIVOTS.COM & E-MINIPIVOTS.COM: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHARTS & ACTIVE ADVANCED MANAGEMENT OTAPS-PPS GUIDEMAPS UPDATE: /YM DOW FUTURES: THUR 2/06/14: POWERFUL RESULTS & MAJOR SUCCESS: PREMIUM RELEASES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

GOLDPIVOTS.COM: POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 2/6/14: /GC E-MINI FUTURES PROXY GOLD METALS MARKET ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES

GOLDPIVOTS.COM POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART & OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

QQQPIVOTS.COM POWERFUL RESULTS: FORECAST RIGHT ON TARGET: THU 1/30/14: ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT MODEL GUIDEMAP UPDATES: PREMIUM RELEASE PARTIAL PERSPECTIVES TO FREE ONLINE ALPHA BRAND NEWSLETTERS

S&P500 COMPOSITE /ES EMINI FUTURES: The Presidential, Congressional, Annual, Tri-Quarterly, Bi-Quarterly, Quarterly, Monthly, Tri-Weekly, Bi-Weekly, And Weekly Cycles, & Related Coordinate Forecast EchoVectors & OTAPS Position Polarity Switch Vectors

THIS WEEK'S ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND ACTIVE ADVANCED MANAGEMENT OTAPS POSITION POLARITY SWITCH GUIDEMAP UPDATES: QQQ ETF, GLD ETF, USO ETF, /YM DOW FUTURES, /ES S&P500 FUTURES, LAST WEEK'S POWERFUL RESULTS: UPDATE MONDAY 1/27/14

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE PRICE FORECAST OTAPS VECTOR SWITCH GUIDEMAP UPDATES: LARGE CAP EQUITIES COMPOSITE INDEX FORECAST AND ALERTS RIGHT ON TARGET: PREMIUM NEWSLETTER ANALYSIS PARTIAL RELEASE: THURSDAY 1/23/14:

USO ETF AND GTU ETF: ECHOVECTOR ANALYSIS PIVOT POINT PRICE PROJECTION FRAMECHART UPDATES & TRADER'S EDGE OTAPS PRICE FORECAST GUIDEMAPS: OILPIVOTS.COM CRUDE OIL & GOLDPIVOTS.COM GOLD METALS FOCUS INTEREST PROXY FRAMECHARTS: WEDNESDAY 1/22/14

/YM EMINI DOW FUTURES & QQQ ETF: ECHOVECTOR ANALYSIS PIVOT POINT PRICE PROJECTION FRAMECHART UPDATES & TRADER'S EDGE OTAPS PRICE FORECAST GUIDEMAPS: DOWPIVOTS.COM DJIA & QQQPIVOTS.COM NASDAQ-100 FOCUS INTEREST PROXY FRAMECHARTS: TUESDAY 1/21/14 UPDATES

/YM FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE PRICE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST AND ALERT RIGHT ON TARGET: FRIDAY 17 JANUARY 2014: EARLY MORNING EUROPEAN PRE-MARKET OPEN UPDATE

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST & ALERT RIGHT ON TARGET: POWERFUL FORECAST RESULTS FOR THURS 1/16/14 LATE MORNING: DOWPIVOTS.COM

QQQPIVOTS.COM AND ETFPIVOTS.COM AND MARKETPIVOTS.COM: QQQ ETF ECHOVECTOR ANALYSIS FRAMECHART AND TRADER'S EDGE GUIDEMAP UPDATE: KEY ANNUAL ECHOVECTOR AND QUARTERLY ECHOVECTORS HIGHLIGHTED & ILLUSTRATED: RIGHT ON TARGET: POWERFUL RESULTS: THURSDAY 1/16/14

/YM DOW FUTURES DJIA PROXY ECHOVECTOR FRAMECHART & TRADER'S EDGE GUIDEMAP UPDATE: ECHOVECTORVEST MDPP PRECISION PIVOTS LARGE CAP EQUITIES COMPOSITE FORECAST & ALERT RIGHT ON TARGET: POWERFUL FORECAST RESULTS FOR THURSDAY 1/16/14: DOWPIVOTS.COM

GTU ETF PROXY GOLD METALS MARKET ECHOVECTOR ANALYSIS FRAMECHART: Mid-Week EchoVector Analysis FrameChart And EchoVector Pivot Point Price GuideMap: ECHOVECTOR ANALYSIS RIGHT ON TARGET!

USO CRUDE OIL ECHOVECTORVEST ALERT ON SUNDAY 29 DECEMBER 2013 RIGHT ON TARGET: POWERFUL RESULTS FROM DOUBLE-DOUBLE LEVERAGE ALERT: MULTI-PERSPECTIVE ECHOVECTOR ANALYSIS & FRAMECHART & PRICE MAP UPDATE FOR MONDAY 1/1314: OILPIVOTS.COM & COMMODITYPIVOTS.COM

BONDPIVOTS.COM AND MARKET-PIVOTS.COM: TLT ETF ECHOVECTORVEST MDPP FORECAST AND ALERT RIGHT ON TARGET: ECHOVECTORVEST MDPP PRECISION PIVOTS TREASURY LONG BOND PRICE MAP ALERT AND FRAMECHART UPDATE: TLT ETF PROXY: FRIDAY 10 JANUARY 2014: RIGHT ON TARGET

SPX S&P500 ECHOVECTOR FRAMECHART UPDATES: 16Y MATURITY, 8Y REGIME CHANGE, 6Y SENATORIAL, 5Y FEDERAL RESERVE, 4Y PRESIDENTIAL, & 2Y CONGRESSIONAL CYCLE PERSPECTIVES W/ KEY ACTIVE ECHOVECTORS & ECHOBACKDATES: MARKET-PIVOTS.COM & SPYPIVOTS.COM: 1/9/14 UPDATE

GLD ETF ECHOVECTOR FRAMECHART AND PRICE MAP UPDATES: GOLDPIVOTS.COM & COMMODITYPIVOTS.COM & ETFPIVOTS.COM & MARKET-PIVOTS.COM: : PREMIUM RELEASE PARTIAL PERSPECTIVES AND ANALYSIS TO ALPHA BRAND NEWSLETTERS FOR GENERAL PUBLIC PURVIEW: 1/9/14: ON TARGET

SCROLL DOWN TO VIEW SELECT NEWSLETTERS

ECHOVECTOR ANALYSIS FRAMECHARTS OF THE DAY

ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS OF THE DAY

ACTIVE ADVANCED MANAGEMENT OTAPS-PPS POSITION POLARITY COVER AND SWITCH SIGNAL INDICATOR

TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

ACTIVE ADVANCED MANAGEMENT OTAPS-PPS POSITION POLARITY COVER AND SWITCH SIGNAL INDICATOR

TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

COORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION FRAMECHARTS

AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL TIME/PRICE VECTOR GUIDEMAPS OF THE DAY

ADDITIONAL POSITION ALERTS AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL ALERTS

AND STRATEGY NOTES OF THE DAY

AND STRATEGY NOTES OF THE DAY

COMMENTARY, ANALYSIS, OUTLOOKS, AND FORWARD FORECASTS OF THE DAY

AND COMING SELECTED FOCUS INTEREST OPPORTUNITIES

AND COMING SELECTED FOCUS INTEREST OPPORTUNITIES

HOW TO ENLARGE FRAMECHARTS AND PRICE MAPS

______________________________________________________________________________________

HOW TO ENLARGE ECHOVECTORVEST MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS FRAMECHARTS AND FORECAST MODEL PRICE MAP IMAGES ON YOUR COMPUTER MONITOR'S DISPLAY

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

1. Left click on presented image of chart to open image of chart in new tab.

2. Right click on new image of chart opened in new tab to further zoom and enlarge EchoVector Analysis chart image illustrations and highlights.

______________________________________________________________________________________

Thursday, March 13, 2014

/ES S&P EMINI FUTURES PREMIUM DESK RELEASE FRAMECHARTS AND GUIDEMAP UPDATES FROM MDPP PRECISION PIVOTS: THURSDAY 3/13/14 253PM DST UPDATE QUARTERLY AND MONTHLY AND BI-WEEKLY ECHOVECTORS INTEGRATED PERSPECTIVE HIGHLIGHTED

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES S&P 500 THURSDAY 3/13/14 253PM DST UPDATE FROM FRIDAY 3/11/14

Wednesday, March 12, 2014

/ES S&P EMINI FUTURES PREMIUM DESK RELEASE FRAMECHARTS AND GUIDEMAP UPDATES FROM MDPP PRECISION PIVOTS: THURSDAY 3/13/14 1253AM DST UPDATE

QUARTERLY AND MONTHLY AND BI-WEEKLY ECHOVECTORS INTEGRATED PERSPECTIVE HIGHLIGHTED

THURSDAY 3/13/1 1253AM DST UPDATE FROM FRIDAY 2/21/14

ABBREVIATED (QUICK-CODE) COLOR CODE GUIDE

QEV

QUARTERLY ECHOVECTORS: WHITE, GREEN

MEV

MONTHLY ECHOVECTORS: PINK

2WEV

BI-WEEKLY ECHOVECTORS: YELLOW

WEV: WEEKLY ECHOVECTORS: WHITE

SELECT COORDINATE EXTENSION VECTORS: BLUE-PURPLE, RED

_____________________________________________________________

Wednesday, March 12, 2014

/ES S&P EMINI FUTURES PREMIUM DESK RELEASE FRAMECHARTS AND GUIDEMAP UPDATES FROM MDPP PRECISION PIVOTS: WEDNESDAY 1200PM DST UPDATE

12PMDST UPDATE

1153AMDST

1158AMDST

Wednesday, March 12, 2014

/ES WEEKLY AND DAILY 8AM WEDNESDAY REFERENCE POINT ECHOVECTORS

7-DAY 15-MINUTE OHLC SIMPLE ECHOVECTOR ANALYSIS CONSTRUCT PERSPECTIVE HIGHLIGHTED AND ILLUSTRATED

933AMDST

939AMDST

944AMDST

950AMDST

953AMDST

SHORT-TERM TRADE ALERT COVER SIGNAL DIA ETF $162.55 PEB

Tuesday, March 11, 2014

/ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMCHART AND OTAPS-PPS POSITION POLARITY SWITCH SIGNAL GUIDEMAP UPDATE: S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES PROXY: TUESDAY MARCH 11 2014 555PM EST UPDATE: AMERICAN EXTENDED MARKET HOURS: CONGRESSIONAL CYCLE. ANNUAL CYCLE, BI-QUARTERLY CYCLE, AND QUARTERLY CYCLE PERSPECTIVES ILLUSTRATED AND HIGHLIGHTED WITHQUARTERLY CYCLE ZOOMCHART: MARKETPIVOTSONLINE.COM AND ECHOVECTOR.INFO AND MARKETINVESTORWEEKLY.COM AND BRIGHTHOUSEPUBLISHING.COM WEEKEND ARTICLE INCLUDED

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/es 455pm dst

ALERT: QUARTERLY CYCLE ECHOVECTOR AND WEEKLY CYCLE ECHOVECTOR ALERT: POTENTIAL RELATIVE STRENGTH WEAKNESS FOR COMING WEEK STARTING TUESDAY

Sunday, March 9, 2014

/ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMCHART UPDATE: S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES PROXY: SUNDAY MARCH 9 2014 7:14PM EST UPDATE: ASIAN PRE-MARKET HOURS: CONGRESSIONAL CYCLE. ANNUAL CYCLE, BI-QUARTERLY CYCLE, QUARTERLY CYCLE, AND BONUS 16-YEAR ECHOVECTOR ANALYSIS MATURITY CYCLE PERSPECTIVES ILLUSTRATED AND HIGHLIGHTED: MARKETPIVOTSONLINE.COM AND ECHOVECTOR.INFO AND MARKETINVESTORWEEKLY.COM AND BRIGHTHOUSEPUBLISHING.COM WEEKEND ARTICLE INCLUDED

Summary

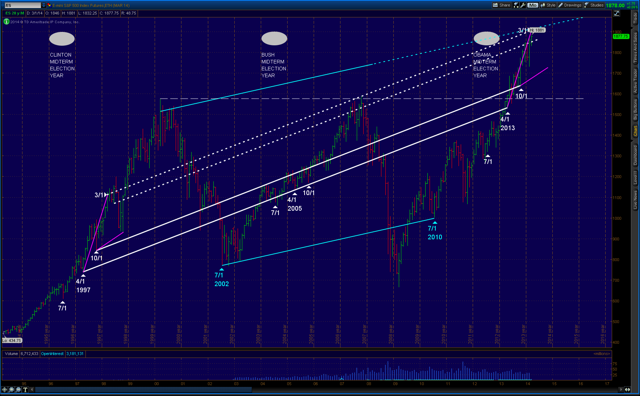

S&P 500 Stock Composite Index /ES E-mini Futures 20-Year Monthly OHLC Perspective

Kevin John Bradford Wilbur is the Chief Market Strategist and Senior EchoVector Analysis Methodologist at PROTECTVEST AND ADVANCEVEST. He is a prize-winning Economist and Financial Physicist with an over 35 year span of experience and awards in Academics, Research, Management, Practice and Trade. Kevin has specialized experience in the Major Market Indexes, Commodities, ETFs, and in derivatives and the derivatives markets.

Search market pivots to read more about Kevin John Bradford Wilbur and his specialty,and about THE MARKET ALPHA BRAND NEWSLETTER GROUP.

DISCLAIMER

/ES 330PMEST

BONUS CHART

SPX 333PMEST

20-YEAR WEEKLY OHLC ADVANCED ECHOVECTOR ANALYSIS FRAMECHART

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

/ES 120AMDST

AND

AND

And

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES 120AMDST

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

Friday, March 7, 2014

S&P500 AND SPY AND /ES EMINI FUTURES ARTICLE: PREMIUM DESK RELEASE TO SPYPIVOTS.COM AND SPYPIVOTSONLINE.COM AND MARKET-PIVOTS.COM AND MARKETPIVOTSONLINE.COM AND ETFPIVOTS.COM AND EMINIPIVOTS.COM AND EMININEWS.COM

The American Political Economic Cycle And The Current Melt-Up in Stocks: A Powerfully Revealing EchoVector Analysis of the Current 5-Year Bull Market In Stocks And An Update Of The Article "Don't Fight The Fed"

Kevin Wilbur, Chief Market Strategist And Senior EchoVector Analysis Methodologist

Market Alpha Brand Newsletters Group, PROTECTVEST AND ADVANCVEST

Friday, March 7, 2014 Updated Version

Friday, March 7, 2014 Updated Version

- The bull market is ready to celebrate its 5TH anniversary, but how much longer will the bull run?

- The modern era in market structures, market participation, and advanced forecasting techniques may help generate its own momentum.

- The Federal Reserve leads a significant coordinated global central bank intervention to stabilize and support the stock market during the 2012 presidential midterm election year.

- An inspection of stock market prices reveals a pattern of significant melt-up after the midterm election year in last three US Administrations, the era of the Internet.

- The stock market momentum (EchoVector Momentum Indicator) that follows from the post presidential midterm election year and runs through all three administrations is still right on course, and offers a strong indicator to this year's forecast. See April 1997 to April 2005 to April 2013.

- Prices may now appear toppy, but coordinate symmetry transposition from the last two regime change cycles also supports the case an an additional up-wave from this coming Fall's price lows. Will fall lows be higher or lower than the current price level this March, and what might investors and traders do next to prepare?

ARTICLE

BACKGROUND

This week several analyst have published articles celebrating the markets 5-year bull run since the lows of the great 2008-2009 sell-of the second week of March 2009. Few bull markets have last longer than five years. What I find interesting is many of these each article's primarily thesis is on the technicals, and assessing longer term historical bull market lengths and measures. One even states "Part of what makes it so difficult to forecast what is going to happen next right now is history's lack of clear insight." This often gets mentioned in periods of price over-extension, whether up or down. I do not agree with this assessment, and believe instead that history does give insight if you are looking in the right place and within the right contextual and analytic framework.

Perhaps a closer review of shorter-term history covering the last 20 years might give us important new insight into where the market may go from here. A review that also takes into account the political economic cycles as well as key and consistent market momentum indicators, while also considering internationally coordinated central bank imperatives and interventions. Also accounting for, and contexting, vast structural changes in market evolution is important

Dramatic structural changes in the stock market through the last 20 years, and an explosion in market participation during the age of the Internet have occurred. Windows 95 has a 20 year birthday coming up. So it's not the market your grandfather use to trade, if he traded one at all. Broad market participation across the globe is also expanding. The evolution in market structure, in market participation, and in analytic tools and techniques has been breathtaking. All three of these evolving market components lend themselves to the development of new analytic frameworks in understanding market price dynamics and forecasting. This is especially the case within the overall advancement of computer supported market analysis, black box investing approaches, and the ever accelerating and voluminous information age.

I believe a different and closer inspection of the market focusing on the political economic cycle, and specifically the last three presidential administration cycles and the 2 years following the midterm presidential elections, and recent key central bank price stabilization imperatives, and the utilization of the EchoVector Market Momentum Indicator through these periods, may be particularly useful now in framing a valid understanding where the market may move next.

THE FEDERAL RESERVE AND STABILIZING MIDTERM ELECTION YEAR PRICES

In August of 2012 I wrote an article examining the Federal Reserve Bank's interest in avoiding excessive market volatility in the a presidential midterm election year of 2012, and instead the Bank wanting to be a significant and effective force and national institution promoting economic stability and economic encouragement to the American electorate during that important political economic and financially sensitive time. In that article, titled Don't Fight The Fed, I explained how the US Federal Reserve Bank lead a global central bank coordinated and orchestrated effort to support stock prices and the wealth effect with a Federal Reserve Bank generated composite stock market price support level bridge during one of the most vulnerable periods in the political economic cycle. Supporting composite stock market price levels and preventing potentially ensuing cyclical price level erosion, and positively trajecting prices further upward instead, was the purpose of this coordinated global central bank intervention.

This article is a follow-up of my previous article. In it I would like to focus on, and to review, how large cap composite equity prices have in fact responded to this past mid-term American presidential election cycle globally coordinated central bank intervention which occurred in the summer of 2012 within the US political economic cycle, and to take a closer look at the current market price level trajectory induced by the central bank when viewed within the context and the time span of stock market price levels over the last three 8-year American presidential regimes: the Clinton regime, the Bush regime, and now the Obama regime.

A LOOK AT THE LAST THREE US PRESIDENTIAL ADMINISTRATIONS' POST MIDTERM ELECTION MELT-UPS IN STOCKS

Let's begin by looking at the following 20-year price track of the S&P 500 Composite Stock Index as reflected a proxy chart of the popular /ES E-mini Futures on that index.

S&P 500 Stock Composite Index /ES E-mini Futures 20-Year Monthly OHLC Perspective

(click to enlarge)

In the chart above note the key white 16-year market financial cycle echovector running from The April 1, 1997, the echobackdate and year following the Clinton Administration mid-term election year, to the April 1 2005 echobackdate and year following the Bush Administration mid-term election year, to the April 1 2013 echovector start date, and year following the Obama Administration mid-term election year.

Notice also the general horizontal price resistance level highlighted in white running from the Clinton Regime's price level toppiness in year 2000 to the Bush Regime price level toppiness in year 2007 to the late spring and summer time sell in May and go away period of the Obama Regime in 2013.

In May of 2013 prices had faltered at this critical time and price level and fell nearly 10% into June. Rallying off the June lows prices began to fall back again in August, potentially setting up a toppy formation much like that in 2007.

It was in the Federal Reserve Bank's genuine interest, and in The Federal Reserve Bank Chairman's focus, his specialty, and his legacy interest, to prevent another market collapse reminiscent of 2008 or 2001-2002, and this seasonal price pressure weakness from accelerating into a more precarious market price phenomena and political economic market cycle echo. And the central bank's ensuing coordinated efforts to place a bridge under stock market prices that summer could not have been more effective nor better timed for this purpose.

The bridge in place, and holding well into November, and that month's returning annual and congressional cycle lows kicking in, with them occurring at these upper and bridged supported price levels, set the stage for significantly better price level momentum trajectory than otherwise, and eventual price level resistance breakthrough and price melt-up, in lieu of price level collapse. Whereas these last three regime mid-term election years appear characterized by little price progress going into July after their first quarter highs, the year that follows, being year 5 in the existing administration's regime change cycle, holds onto momentum price gains on both a year-over-year basis and on a 2-year congressional cycle basis. The latter being even stronger, accelerating prices even further and propelling them into melt-up. This effect was anticipated in my article of August 2012, and has been central to my positive market forecast since.

OUTLOOK

Some analyst have been calling for a pullback from high's this quarter into lower lows this fall, with a bounce back to higher highs going into next year. The above analysis would tend to support such an outlook.

However, currently vigilance and caution at the high price level present may be the better part of wisdom. We have gained over 44% on the S&P since August 2012, and have completed what might be viewed, at best, as the first half of a melt-up that occurs before a potential second wave of melt-up cyclically begins in the second half of this year. Be mindful that sometimes the market, anticipating far enough into the future cyclically, seems to rush to get there early, accomplishing momentum over-extension. This might have also, in part, contributed to the drama of 2008 with regard to downside extension.

At this time within this regime change cycle within the political economic cycle, and at current price levels, my suggestion is to remain nimble, and to let the best price extension scenario evolve, but to also remain ready to lock in gains through hedging utilities in the event of scope relative counter-cyclical occurrences, and to do so possibly right up into the second quarter of next year.

One way to accomplish being nimble would be to set up an active and adjustable OTAPS position polarity switch and straddle to manage your general stock market exposure to any potential changes in the general price level momentum and your forward outlook. Setting straddles at momentum echovector switch level prices is an effective and opportune measure and advanced trade and position management strategy.

One way to employ such a straddle would be to utilize the SPY ETF and/or the DIA ETF. By setting up an advanced trade technology (see "On-Off-Through Vector Target Price Switch") at, for example, $190 on the SPY or at $166 on the DIA, with appropriate dynamic triggers and stops included, such a straddle can be employed.

To perform the short side of the straddle, set a short trigger below either of these mentioned target price switch levels (e.g., $190 on the SPY and/or $166 on the DIA) pre-programmed as a "repeating short trigger switch" at the trigger level on reverse down-tick action through the trigger price, with stops set to activate on reverse uptick up-through action.

To perform the long side of the straddle, set a long trigger above either of these the target price switch levels ($190 on the SPY and/or $166 on the DIA) pre-programmed as a "repeating long trigger switch" at the trigger level on reverse uptick action through the trigger, with stops set to activate on reverse down-tick down-through action.

Now may be a very good time to employ this general market straddle and this more advanced trade technology switch and active position management methodology, especially when reviewing the proxy chart of the S&P 500 over the past 20 years within the current presidential regime change cycle.

Thanks for reading. And Godspeed in your investing.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Contributor, Alpha Brand Newsletters Group

Chief Market Strategist And EchoVector Analysis Methodologist

PROTECTVEST AND ADVANCVEST

Search market pivots to read more about Kevin John Bradford Wilbur and his specialty,and about THE MARKET ALPHA BRAND NEWSLETTER GROUP.

For further information on constructing and calculating echovectors, coordinate forecast echovectors, and echovector pivot points, see "The Simple Single-Period EchoVector Pivot Point Calculation".

For further information on constructing and calculating otaps-pps position polarity cover and/or switch signal vectors and their trigger points, see "The On-Off-Through Vector Target Application Price Switch And Position Polarity Cover And/Or Switch Signal Vector Trigger Points".

See THE MARKET PIVOTS FORECASTER AND POSITION MANAGEMENT NEWSLETTER for further updates that might develop regarding this analysis.

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial adviser.

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

Thursday, March 6, 2014

/ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMCHART UPDATE: S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES: FRIDAY 7 MARCH 2014 220AM EST: EUROPEAN PRE-MARKET HOURS

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

/ES 220AMEST

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES 220AMEST

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

Wednesday, March 5, 2014

Wednesday, March 5, 2014

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH TARGET PRICE FORECAST GUIDEMAP UPDATES: WEDNESDAY 5 MARCH 2014 333PM EST: US MARKET AFTERNOON HOURS

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES 315PMEST

/ES 330PMEST

BONUS CHART

SPX 333PMEST

20-YEAR WEEKLY OHLC ADVANCED ECHOVECTOR ANALYSIS FRAMECHART

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

Wednesday, March 5, 2014

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH TARGET PRICE FORECAST GUIDEMAP UPDATES: WEDNESDAY 5 MARCH 2014 300AM EST: EUROPEAN MARKET MORNING HOURS

/ES S&P500 E-MINI FUTURES 2-YEAR DAILY OHLC

/ES S&P500 E-MINI FUTURES 1-YEAR DAILY OHLC

/ES S&P500 E-MINI FUTURES 6-MONTH DAILY OHLC

/ES S&P500 E-MINI FUTURES 3-MONTH DAILY OHLC

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

/ES S&P500 E-MINI FUTURES 2-YEAR DAILY OHLC

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES S&P500 E-MINI FUTURES 1-YEAR DAILY OHLC

/ES S&P500 E-MINI FUTURES 6-MONTH DAILY OHLC

/ES S&P500 E-MINI FUTURES 3-MONTH DAILY OHLC

PRIOR PREMIUM POST RELEASES TO MARKET ALPHA BRAND NEWSLETTERS FOR ADDITIONAL CONTEXT

Tuesday, March 4, 2014

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH TARGET PRICE FORECAST GUIDEMAP UPDATES: TUESDAY 4 MARCH 2014 1010AM EST: US MARKET MORNING HOURS: MONTHLY ECHOVECTOR ANALYSIS PERSPECTIVE FRAMECHART UPDATE

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHART TO ENLARGE

/ES S&P500 E-MINI FUTURES 1-MONTH HOURLY OHLC

KEY CYCLE ECHOVECTOR ANALYSIS PERSPECTIVES HIGHLIGHTED

FROM KEY SELECT STARTING BASE TIME/PRICE POINT 6AM MONDAY 2 FEB 2014

4-WEEK: PINK

3-WEEK: GREY

2-WEEK: YELLOW

1-WEEK: WHITE

ECHOVECTOR ANALYSIS MONTHLY FRAMECHART PERSPECTIVE

BASE PERSPECTIVE START POINT:

6AM MONDAY 2 FEB 2014

WITH KEY CYCLE LENGTH ECHOBACKDATETIMEANDPRICE POINTS

HIGHLIGHTED AND ILLUSTRATED

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

/ES S&P500 E-MINI FUTURES 1-MONTH HOURLY OHLC

KEY CYCLE ECHOVECTOR ANALYSIS PERSPECTIVES HIGHLIGHTED

FROM KEY SELECT STARTING BASE TIME/PRICE POINT 6AM MONDAY 2 FEB 2014

4-WEEK: PINK

3-WEEK: GREY

2-WEEK: YELLOW

1-WEEK: WHITE

ECHOVECTOR ANALYSIS MONTHLY FRAMECHART PERSPECTIVE

BASE PERSPECTIVE START POINT:

6AM MONDAY 2 FEB 2014

WITH KEY CYCLE LENGTH ECHOBACKDATETIMEANDPRICE POINTS

HIGHLIGHTED AND ILLUSTRATED

Monday, February 24, 2014

S&P500 STOCK COMPOSITE INDEX /ES EMINI FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART AND OTAPS-PPS POSITION POLARITY SWITCH TARGET PRICE FORECAST GUIDEMAP UPDATES: MONDAY 24 FEBRUARY 2014 1014PM EST: ASIAN MARKET MORNING HOURS: QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE FRAMECHART UPDATE

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHARTS TO ENLARGE

/ES S&P500 E-MINI FUTURES 5-YEAR DAILY OHLC

WITH 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 6-MONTH BI-QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 3-MONTH QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

SPYPIVOTS.COM AND E-MINIPIVOTS.COM AND MARKET-PIVOTS.COM AND ETFPIVOTS.COM: MDPP PREMIUM DESK PARTIAL RELEASE TO FREE ONLINE MARKET ALPHA BRAND NEWSLETTER GROUP BY BRIGHTHOUSE PUBLISHING AND TO SEEKINGALPHA.COM

FOR FURTHER AND MOST RECENT AND TIMELY FREE ONLINE PUBLIC RELEASE UPDATES SEE

AND

RSS FEEDS AVAILABLE

Themes: Stock Market Education, Futures, Federal Reserve, Market Currents, ETFs, Macro View, Alerts, Market Outlook, Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas, Commodities,EchoVectorVEST, Technical Analysis, MDPP Precision Pivots Forecast

Stocks: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS

CLICK ON CHARTS TO ENLARGE

/ES S&P500 E-MINI FUTURES 5-YEAR DAILY OHLC

WITH 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 6-MONTH BI-QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 3-MONTH QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

CLICK ON CHARTS TO ENLARGE

/ES S&P500 E-MINI FUTURES 5-YEAR DAILY OHLC

WITH 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 6-MONTH BI-QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH 3-MONTH QUARTERLY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

WITH WEEKLY AND DAILY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

SPY L1 OPTION RIDER VEHICLES - LONG SIDE- CALLS - WEEKLYS

SPY L1 OPTION RIDER VEHICLES - SHORT SIDE- PUTS - WEEKLYS

BONUS FRAMECHARTS

/ES FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART

PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE

/ES S&P500 E-MINI FUTURES 5-YEAR DAILY OHLC WITH PCEVAP

ZOOMED

FEB 2010

FEB 2014

"WE'RE KEEPING WATCH FOR YOU"

WITH WEEKLY AND DAILY ECHOVECTOR ANALYSIS PERSPECTIVE HIGHLIGHTED

SPY L1 OPTION RIDER VEHICLES - LONG SIDE- CALLS - WEEKLYS

SPY L1 OPTION RIDER VEHICLES - LONG SIDE- CALLS - WEEKLYS

SPY L1 OPTION RIDER VEHICLES - SHORT SIDE- PUTS - WEEKLYS

BONUS FRAMECHARTS

/ES FUTURES ECHOVECTOR PIVOT POINT ANALYSIS FRAMECHART

PRESIDENTIAL CYCLE ECHOVECTOR ANALYSIS PERSPECTIVE

/ES S&P500 E-MINI FUTURES 5-YEAR DAILY OHLC WITH PCEVAP

ZOOMED

FEB 2010

FEB 2014

"WE'RE KEEPING WATCH FOR YOU"

Subscribe to: Post Comments (Atom)