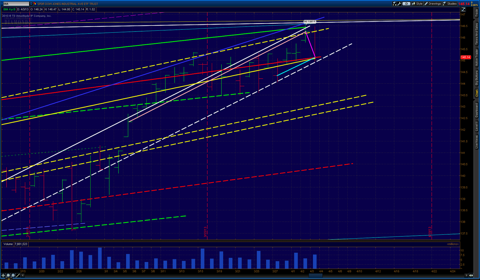

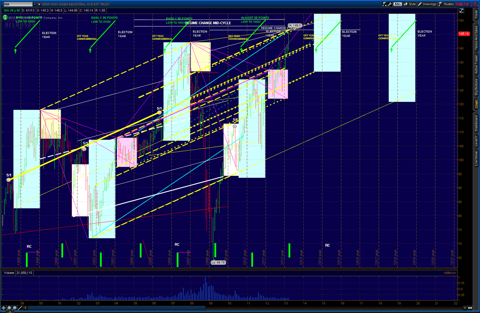

Dow Pivots: Charts And Analysis: DIA ETF: Quarterly (100 Day) And Bi-Monthly And Weekly Perspectives With Key EchoVectors, Focus Extension EchoVectors, EchoBackDates, And EchoBackPeriods Highlighted: Last Week's Forecast Right On Target To Hour: See Chart [Edit orDelete]0 comments

DIA ETFCHART ECHOVECTOR COLOR CODE GUIDELINES1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy BlueSpace-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.__________________________________________________________Last Week's Publically Provided and Published MDPP Model Illustration Charts And Precision Pivots Trade's Edge EasyGuide Forecast Highlight ChartsApr 4, 2013 5:00 AMDIA ETF 1-MONTH DAILY OHLC

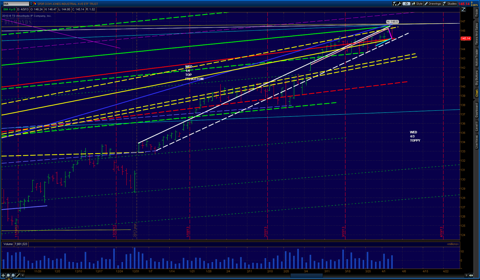

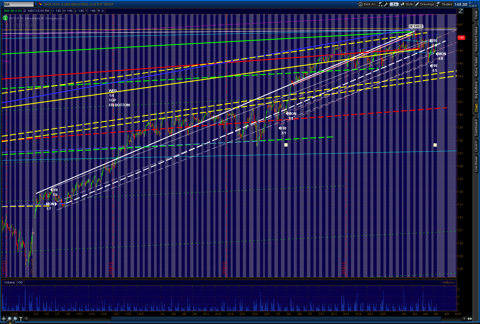

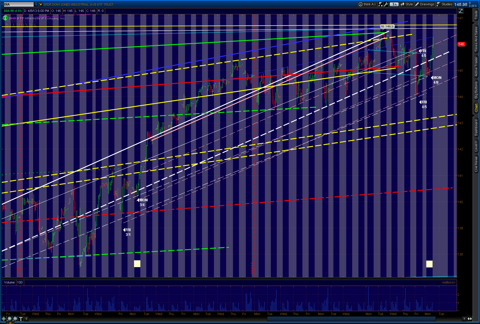

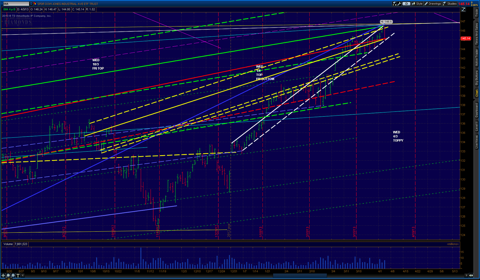

WITH MONTHLY (PEACH), WEEKLY (AQUABLUE), AND DAILY (PINK) ECHOVECTORS, COORDINATE(Click on charts to enlarge and click on charts again to open new tab then click on charts in new tab to further zoom)DIA ETF 3-MONTH DAILY OHLCThis Week's Publically Provided and Published MDPP Model Illustration Charts And Precision Pivots Trade's Edge EasyGuide Forecast Highlight Charts: Updates and Confirmation Charts.Monday 8 April 2013:Example Precision Pivots Price Equivalency Basis Rider Vehicle for Monday Morning's Level 1 Short Positioning: Spy April 20 155 PUT. Example Precision Pivots Price Equivalency Basis Rider Vehicle for Monday Afternoon's Recovery Level 1 Long Positioning: Spy April 20 156 Call._____________________________________ Dow Pivots: Charts And Analysis: DIA ETF: 16-Year Monthly Perspectives With Key Regime Change Cycle (8-Year), Presidential Cycle (4-Ye.ar), And Focus Extension EchoVectors, EchoBackDates,and EchoBackPeriods Highlighted [Edit or Delete]0 commentsApr 4, 2013 5:00 AM | about stocks: SPY SH, SSO, SDS, QQQ, PSQ,QLD, QID, IWM,RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH,IEF, UUP, UDN, GLD,GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS,AGQ, ZSL, CU, PALL, PPLT,VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV,TQQQ, SQQQ, SPLVLooking at the Large Cap Equities Market, we see that we are entering another interesting phase of the Congressional 2-Year Cycle as well as an interesting phase in the 4-Year Presidential Cycle and in the 8-year Regime Change Cycle.The Annual Cycles and Bi-Quarterly Cycle and Quarterly Cycle and Monthly Cycle and Weekly Cycle are also of interest and will be discussed later.Last year we were at these levels, pausing and consolidating a bit here before starting a major early May fall climb accelerating into early June before reversing.Two years ago this week, during a significant consolidation period, we also retouched our momentum high reached in early February that year. Although an absolute price high was reached at the beginning of May, this gave way, and after consolidating prices fell dramatically in July from the February and April momentum high levels, shaving 18% off the dow by October.For this reason, Our Model has indicated the placement of protection on General Large Cap Equities Composite positions on the DIA Price Equivalency Basis target of $146.25 at the start of this week, with OTAPs positioning adjustments maintained at this level, and with full Double Double Strategy employed. Further, MDPP L4 Rider Vehicle Derivative Cover Protection and Reverse Polarity Advancement is also indicated.Note, however, that short-term support can be found at for the Large Cap Equities Composite indexes at an OTAPS target of $144.90 on a DIA ETF Price Equivalency Basis.The first significant near-term General Lower Band Potential Adjustment OTAPS Target of $143.90 on the DIA Price Equivalency Basis has currently also been model-generated; although, more strongly supported price action the next several days than forecast may raise this near-term value.Note on the charts that the weekly, monthly, and quarterly echovectors are in parallel coordination, which is a key technical signal.DIA ETFCHART ECHOVECTOR COLOR CODE GUIDELINES1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy BlueSpace-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.(Click on chart to enlarge and click on chart again to open new tab then click on chart in new tab to further zoom)DIA ETF 15-YEAR WEEKLY OHLCDIA ETF 3-YEAR DAILY OHLCDIA ETF 1-YEAR DAILY OHLCDIA ETF 6-MONTH DAILY OHLCDIA ETF 3-MONTH DAILY OHLCDIA ETF 1-MONTH DAILY OHLC

WITH MONTHLY (PEACH), WEEKLY (AQUABLUE), AND DAILY (PINK) ECHOVECTORS, COORDINATEPosted by EchoVectorVEST at 1:30 AMThemes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts, Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas,Commodities, EchoVectorVEST, Technical Analysis Stocks: SH,SSO,SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA,DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ,GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY,XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV__________________________________________________________PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPPPRECISION PIVOTSProviding Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market(Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Doubling Again in the First Half of 2012!... "We're keeping watch for you!"FORECAST MODEL & ALERT PARADIGM & ACTIVE ADVANCED MANAGEMENT & TRADE TECHNOLOGYFor information on EchoVectorVEST MDPP Active Advance Management Trade Technology and Active Advance Management Position Value Optimization Methodology see:*Daytraders interested in shorter-term market mechanics and OTAPS ALERTS also taking advantage of intra-day time-horizon price deltas and advanced OTAPS position management technologies for the DIA, GLD, and USO, also see:Also see Chronologies and Summaries and Results for the EchoVectorVEST MDPP Major Price Delta and Price Pivot ALERTS for the Gold Metals Market (GLD ETF /GC Futures) and the Crude Oil Market (USO ETF and /QM and /CL Futures) in Q2, 2012, and in Q1.EchoVectorVEST MDPP: Powerful Results From A Powerful, Active, and Advanced Forecast And Position Management Methodology.________________________________________________________PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP"We're keeping watch for you."________________________________________________________FOR TODAY'S KEY CHARTS AND ANALYSIS, SEE:AND,________________________________________________________Click on the links below for direct access to the following:OUR RECORD:www.echovectorvest.com/OUR RECORDOUR RESEARCH:www.echovectorvest.com/OUR RESEARCHOUR CURRENT FOCI:www.echovectorvest.com/OUR CURRENT FOCUS INSTRUMENTSTRADEMARK MODEL ONTOLOGY AND TERMINOLOGY MATRIX:www.echovectorvest.com/THE ECHOVECTORVEST MDPP TRADEMARK TERMINOLOGY MATRIXACTIVE ADVANCED POSITION MANAGEMENT TECHNOLOGY:www.echovectorvest.blogspot.com/PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP ADVANCED ACTIVE POSITION MANAGEMENT TECHNOLOGY:THE ON/OFF/THROUGH VECTOR TARGET APPLICATION PRICE SWITCHEXHIBIT WEEK RESULTS:www.echovectorvest.blogspot.com/ADVANCED MANAGEMENT EXHIBIT WEEK RESULTS FOR THE GLD ETF AND THE DIA ETFHIGH FREQUENCY TRADING DEMONSTRATION:www.echovectorvest.blogspot.com/ECHOVECTORVEST MDPP HIGH FREQUENCY TRADING DEMONSTRATION AND POSITION TERMINOLOGYDIAMOND OF SUCCESS:www.echovectorvest.com/THE DIA ETF: THE DIAMOND OF SUCCESSGOLD METALS:LIGHT SWEET CRUDE OIL:www.echovectorvest.com/THE USO AND LIGHT SWEET CRUDE OILBIO, FOUNDER:www.echovectorvest.com/BIO, PRESIDENT AND FOUNDERPosted by EchoVectorVEST________________________________________________________What is ECHOVECTORVEST MDPP?________________________________________________________DISCLAIMERThis post is for information purposes only.There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP.There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP will be achieved.NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.Again, this post is for information purposes only.Before making any investment decisions we recommend you first consult with you personal financial advisor.PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP"We're keeping watch for you."TAGS: Stock Market Education, ETF Analysis, Major Market Composite Index, Market Outlook, Market Analysis, Technical Analysis, Cyclical Analysis, Price Analysis, Economy, Macro Outlook, Trading, Day Trading, Swing Trading, Investing, Dow Futures, S&P Futures, Stock Market Education, Market Forecast, Market Opinion and Analysis, EchovectorVEST, Portfolio Insurance, Portfolio ManagementSimple template. Powered by Blogger.RELATED LINKS MEMBERThemes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts,Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis,Long Ideas,Commodities, EchoVectorVEST, Technical AnalysisStocks: SH, SSO,SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLTI wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

MEMBERThemes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts,Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis,Long Ideas,Commodities, EchoVectorVEST, Technical AnalysisStocks: SH, SSO,SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLTI wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.- EchoVectorVEST MDPP at Twitter

- EchoVectorVEST MDPP at Our Record

- EchoVectorVEST MDPP at SeekingAlpha/Instablogs

- EchoVectorVEST MDPP at SeekingAlpha/Articles

- EchoVectorVEST MDPP at LinkedIn

- EchoVectorVEST MDPP at Yahoo/Contributor

- What Is EchoVectorVEST MDPP?

Themes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts, Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas,Commodities, EchoVectorVEST, Technical Analysis Stocks: SSO, SDS,QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM,DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU,SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX,XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY

DOWPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR DOWPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.dowpivots.com

CLICK HERE TO GET TO MPF

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

MPF CONSOLIDATED FEED

HOW TO ENLARGE FORECAST FRAMECHARTS

1. Left click on your selected image of the Traders Edge EasyGuide Focus Forecast FrameChart and/or the Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshot.

KEY EVA TIME CYCLE LENGTHS

EUM EUROPEAN MARKET

ASM ASIAN MARKET

O OPEN

C CLOSE

EUMO-EUNC CYCLE

USMO-USMC CYCLE

ASMO-ASMC CYCLE

EUMO-USMO CYCLE

USMO-EUMC CYCLE

ASMC-EUMC CYCLE

ASMC-USMO CYCLE

ASMO-USMO CYCLE

ASMO-EUMO CYCLE

EUMO-USMC CYCLE

1HOUREV

2HOUREV

4HOUREV

6HOUREV

12HOUREV

24HOUREV

48HOUREV

72HOUREV

WEV (WEEKLY CYCLE)

2WEV (2-WEEK CYCLE)

MEV (MONTHLY CYCLE),

2MEV(2-MONTH CYCLE)

QEV (QUARTERLY CYCLE)

2QEV (BI-QUARTERLY CYCLE)

AEV (1-YEAR ANNUAL CYCLE)

CCEV (2-YEAR US CONGRESSIONAL CYCLE)

PCEV (4-YEAR US PRESIDENTIAL CYCLE)

RCCEV (8-YEAR US REGIME CHANGE CYCLE)

MTEV (16-YEAR MATURITY CYCLE)

PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED

WITH KEY ACTIVE EBWs, EBDs, CFEVS, AND OTAPS-PPS TARGET VECTORS ALSO HIGHLIGHTED AND ILLUSTRATED

EXAMPLE ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART PERSPECTIVES AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDMAP GRIDS -- NOW FREE ONLINE FOR 2017!