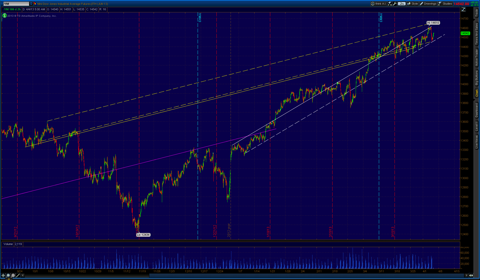

Dow Pivots: Charts And Analysis: /YM Futures: 200-Day Hourly OHLC: 4 March 2013 6AM With Quarterly And Bi-Quarterly Perspectives: Key Active Focus EchoVectors, EchoBackTimePoints, And Coordinate Forecast EchoVectors [Edit orDelete]0 comments

Looking at the Large Cap Equities Market, we see that we are entering another interesting phase of the Congressional 2-Year Cycle as well as an interesting phase in the 4-Year Presidential Cycle and in the 8-year Regime Change Cycle.The Annual Cycles and Bi-Quarterly Cycle and Quarterly Cycle and Monthly Cycle and Weekly Cycle are also of interest and will be discussed later.Last year we were at these levels, pausing and consolidating a bit here before starting a major early May fall climb accelerating into early June before reversing.Two years ago this week, during a significant consolidation period, we also retouched our momentum high reached in early February that year. Although an absolute price high was reached at the beginning of May, this gave way, and after consolidating prices fell dramatically in July from the February and April momentum high levels, shaving 18% off the dow by October.For this reason, Our Model has indicated the placement of protection on General Large Cap Equities Composite positions on the DIA Price Equivalency Basis target of $146.25 at the start of this week, with OTAPs positioning adjustments maintained at this level, and with full Double Double Strategy employed. Further, MDPP L4 Rider Vehicle Derivative Cover Protection and Reverse Polarity Advancement is also indicated.Note, however, that short-term support can be found at for the Large Cap Equities Composite indexes at an OTAPS target of $144.90 on a DIA ETF Price Equivalency Basis in the Very Short-Term.The first significant forward near-term Lower Band Potential Adjustment OTAPS Target of $143.90 on the DIA Price Equivalency Basis has currently also been model-generated; although, more strongly supported price action the next several days than forecast may raise this near-term value.Note on the charts that the weekly, monthly, and quarterly echovectors are in parallel coordination, which is a key technical signal.DIA ETFCHART ECHOVECTOR COLOR CODE GUIDELINES1. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long AquaBlue

2. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week-to-Week): Long Pink4. Presidential Cycle EchoVector (4 Year, Day-to-Day): Long White5. Congressional Cycle EchoVector (2 Year, Day-to-Day): Green

6. Congressional Cycle EchoVector (2 Year, Day-to-Day): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day-to-Day): Long Pink8. Annual Cycle EchoVector (1 Year, Day-to-Day): Red

9. Annual Cycle EchoVector (1 Year, Day-to-Day): Pink

10. Annual Cycle EchoVector (1 Year, Day-to-Day): Long Blue Purple (Pivot Indicative)11. 9-Month Cycle EchoVector (9 Months, Day-to-Day): Grey12. Bi-Quarterly Cycle EchoVector (6 Months, Day-to-Day): Yellow

13. Quarterly Cycle EchoVector (3 Months, Day-to-Day): White

14. Monthly Cycle EchoVector (1 Month, Day-to-Day): Peach

15. Weekly Cycle EchoVector (1 Week, Day-to-Day): Aqua Blue

16. Daily Cycle EchoVector (1 Day, Day-to-Day): Short Pink17. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy BlueSpace-Color Vector Highlights are Graphical Illustrations of Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key Active Focus EchoVectors.(Click on chart to enlarge and click on chart again to open new tab then click on chart in new tab to zoom)/YM DOW FUTURES 200-DAY HOURLY OHLCThemes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts, Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas,Commodities, EchoVectorVEST, Technical Analysis Stocks: SPY, SH,SSO, SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA,DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ,GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV,TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV

DOWPIVOTS.COM IS A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS. MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND COMMENTARY FOR DOWPIVOTS.COM'S FOCUS INTEREST ETFS AND FUTURES AT ECHOVECTORVEST.BLOGSPOT.COM (LISTED IN LINKS BELOW). See http://echovectorvest.blogspot.com and http://seekingalpha.com/author/kevin-wilbur/instablog/full_index in addition to http://www.dowpivots.com

CLICK HERE TO GET TO MPF

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

The Market Pivots Forecaster

The Dow Pivots Forecaster

The SPY Pivots Forecaster

The QQQ Pivots Forecaster

The Stock Pivots Forecaster

The Bond Pivots Forecaster

The Dollar Pivots Forecaster

The Gold Pivots Forecaster

The Oil Pivots Forecaster

The Commodity Pivots Forecaster

The Currency Pivots Forecaster

The FX Pivots Forecaster

The Options Pivots Forecaster

The Emini Pivots Forecaster

And The Rest Of The Market Alpha Newsletter Group Free Online Version Market Newsletters

THE MARKET PIVOTS FORECAST AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER FREE ONLINE CONSOLIDATED VERSION

ANALYSIS, ALERTS, OTAPS SIGNALS, FOCUS FORECAST FRAMECHARTS, SCENARIO SETUP OPPORTUNITY INDICATOR GIUIDEMAP GRID SNAPSHOTS, ILLUSTRATIONS, COMMENTARY AND MORE!

MPF CONSOLIDATED FEED

HOW TO ENLARGE FORECAST FRAMECHARTS

1. Left click on your selected image of the Traders Edge EasyGuide Focus Forecast FrameChart and/or the Active Advanced Scenario Setup Opportunity Indicator GuideMap Grid Snapshot.

KEY EVA TIME CYCLE LENGTHS

EUM EUROPEAN MARKET

ASM ASIAN MARKET

O OPEN

C CLOSE

EUMO-EUNC CYCLE

USMO-USMC CYCLE

ASMO-ASMC CYCLE

EUMO-USMO CYCLE

USMO-EUMC CYCLE

ASMC-EUMC CYCLE

ASMC-USMO CYCLE

ASMO-USMO CYCLE

ASMO-EUMO CYCLE

EUMO-USMC CYCLE

1HOUREV

2HOUREV

4HOUREV

6HOUREV

12HOUREV

24HOUREV

48HOUREV

72HOUREV

WEV (WEEKLY CYCLE)

2WEV (2-WEEK CYCLE)

MEV (MONTHLY CYCLE),

2MEV(2-MONTH CYCLE)

QEV (QUARTERLY CYCLE)

2QEV (BI-QUARTERLY CYCLE)

AEV (1-YEAR ANNUAL CYCLE)

CCEV (2-YEAR US CONGRESSIONAL CYCLE)

PCEV (4-YEAR US PRESIDENTIAL CYCLE)

RCCEV (8-YEAR US REGIME CHANGE CYCLE)

MTEV (16-YEAR MATURITY CYCLE)

PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED

WITH KEY ACTIVE EBWs, EBDs, CFEVS, AND OTAPS-PPS TARGET VECTORS ALSO HIGHLIGHTED AND ILLUSTRATED

EXAMPLE ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART PERSPECTIVES AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDMAP GRIDS -- NOW FREE ONLINE FOR 2017!

No comments:

Post a Comment